Experience the Power of Productivity

Make your team 40% more efficient. Set up your account in just 2 minutes!

Ensure employees are paid correctly with verified work hours, approved timesheets, and error-free calculations.

Turn tracked work hours into payroll-ready data; accurate, verified, and delivered on time, every cycle.

Active users

Hours Tracked

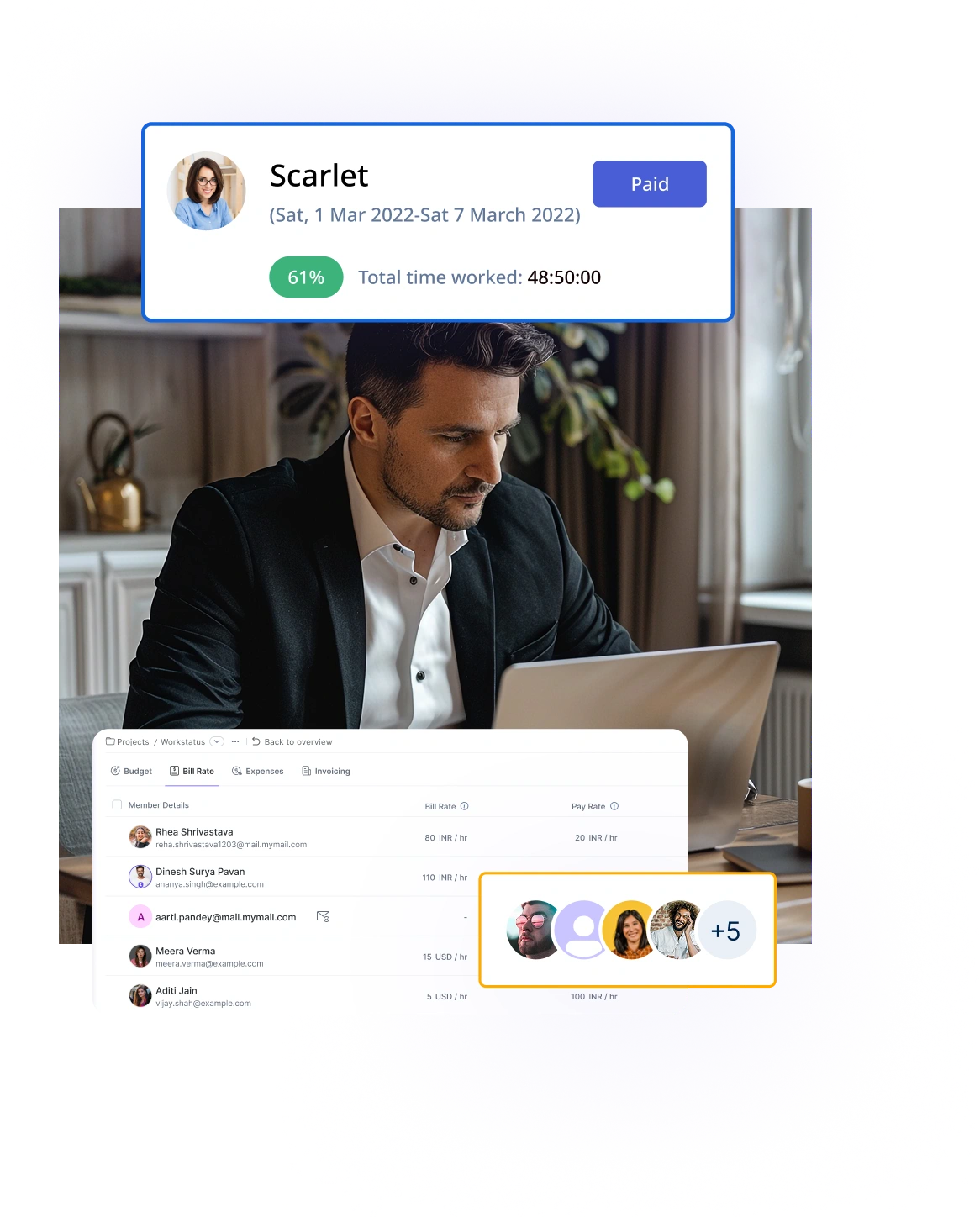

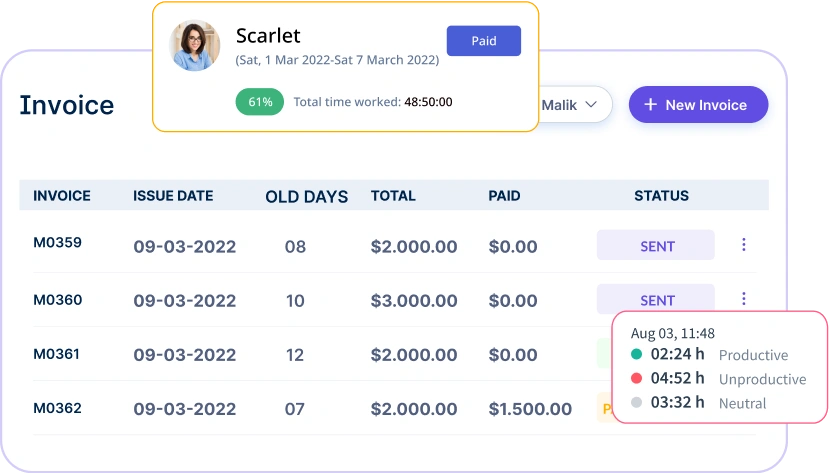

Sync tracked time with pay rates to generate accurate payouts based on billable and non-billable hours.

Accurately link tracked time entries to each employee’s assigned hourly pay rate.

Automatically calculate payouts based on tasks completed or project involvement.

Use time and activity data to back every payment, reducing errors and ensuring transparency with staff.

Access a comprehensive and time stamped log of all entries linked to payroll calculations.

Enable employees to view detailed payout records aligned with their logged work hours.

A multi-national marketing firm, boosted overall efficiency.

Increase Your Team Productivity

A Delhi-based startup achieved 30%+ increased ROI with Workstatus.

Enhance Your Business ROIApply country or region-specific payroll policies to ensure accurate deductions, taxes, and holiday pay.

Ensure accurate application of taxes, benefits, insurance, and deductions based on location.

Automatically calculate pay by including region-specific holidays, leaves, and time-off policies.

Automatically convert work hours into payroll-ready data with zero manual effort.

Keep everything on track without manual work.

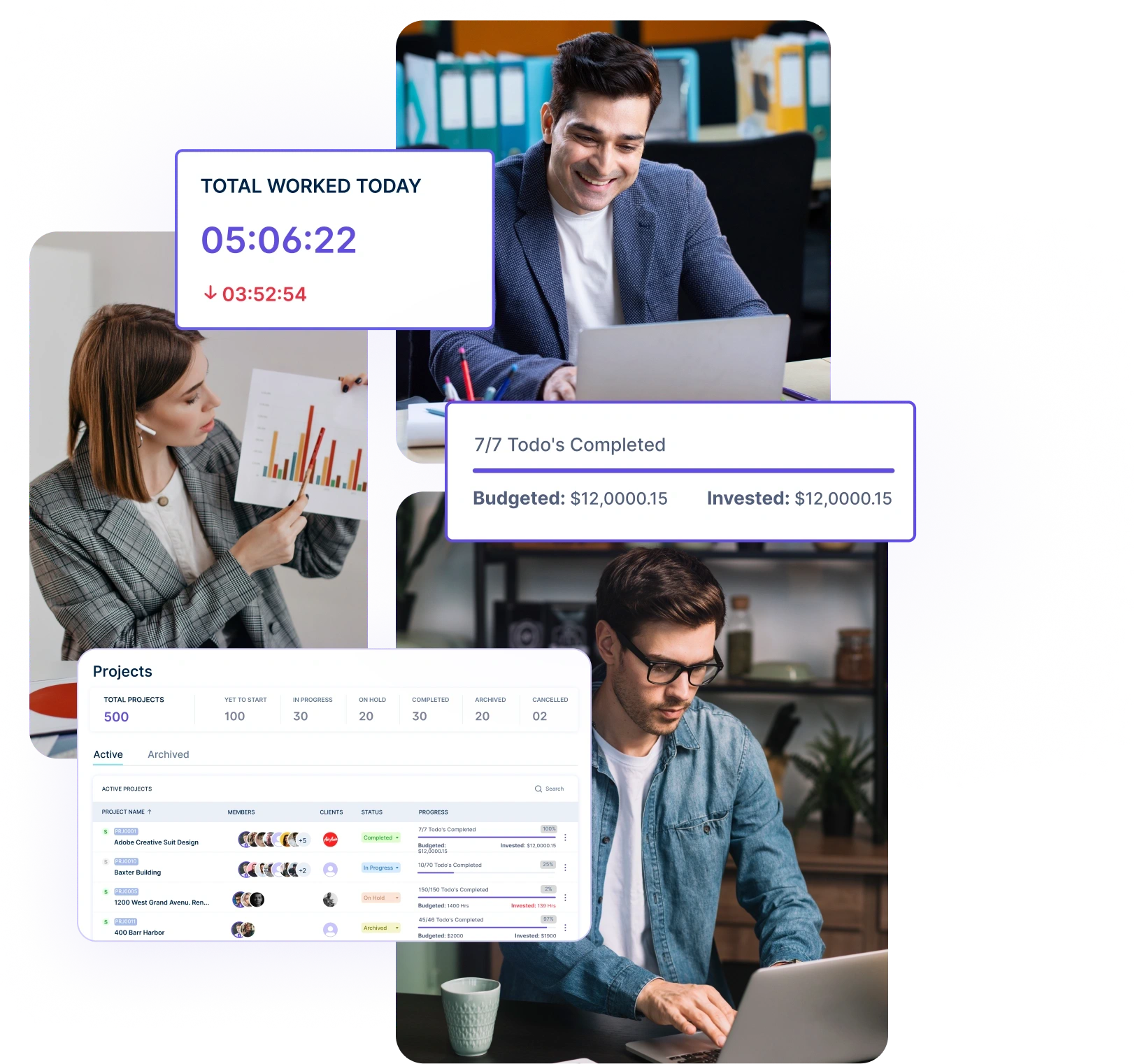

A unified intelligence layer that connects your people, projects, and operations.

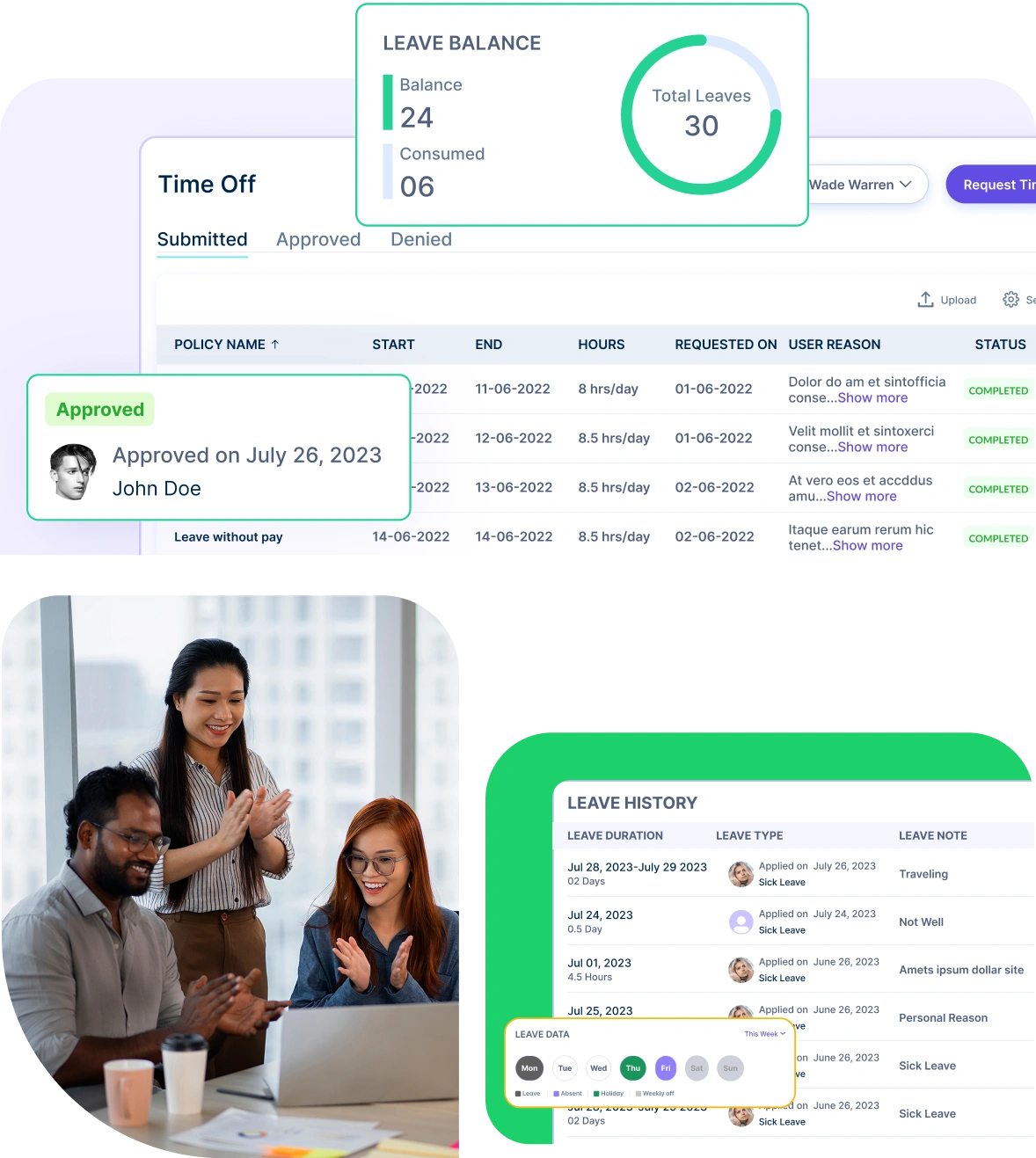

Unlock workforce potential with digital habits, workload signals, and focus trends-without micromanaging.

Real-time visibility into progress, blockers, delivery estimates, and verified balance for every project.

Clear visibility into billable hours and invoice-ready time, ensuring accurate billing and healthier margins.

Cross-team insights into capacity, utilization, and performance health across roles, teams, and departments.

GPS & geofenced check-ins, biometric verification, shift scheduling, payroll, and compliance-all in one place.

Work together effortlessly, no matter where your team is located, with tools that keep communication and collaboration smooth.

Stay connected and accountable

Balance productivity everywhere

Empower field team efficiency

Optimize office productivity

From IT to healthcare, retail to manufacturing, Workstatus adapts to meet your industry’s unique needs.

We provide clarity, no matter the industry, with:

Analyze and assess tools side by side to choose the best fit for your team’s needs and goals.

From time tracking to advanced analytics, Workstatus has everything your business needs to elevate operations.

Workstatus fits seamlessly into your existing tools, connecting time, tasks, and insights without changing how your teams work.

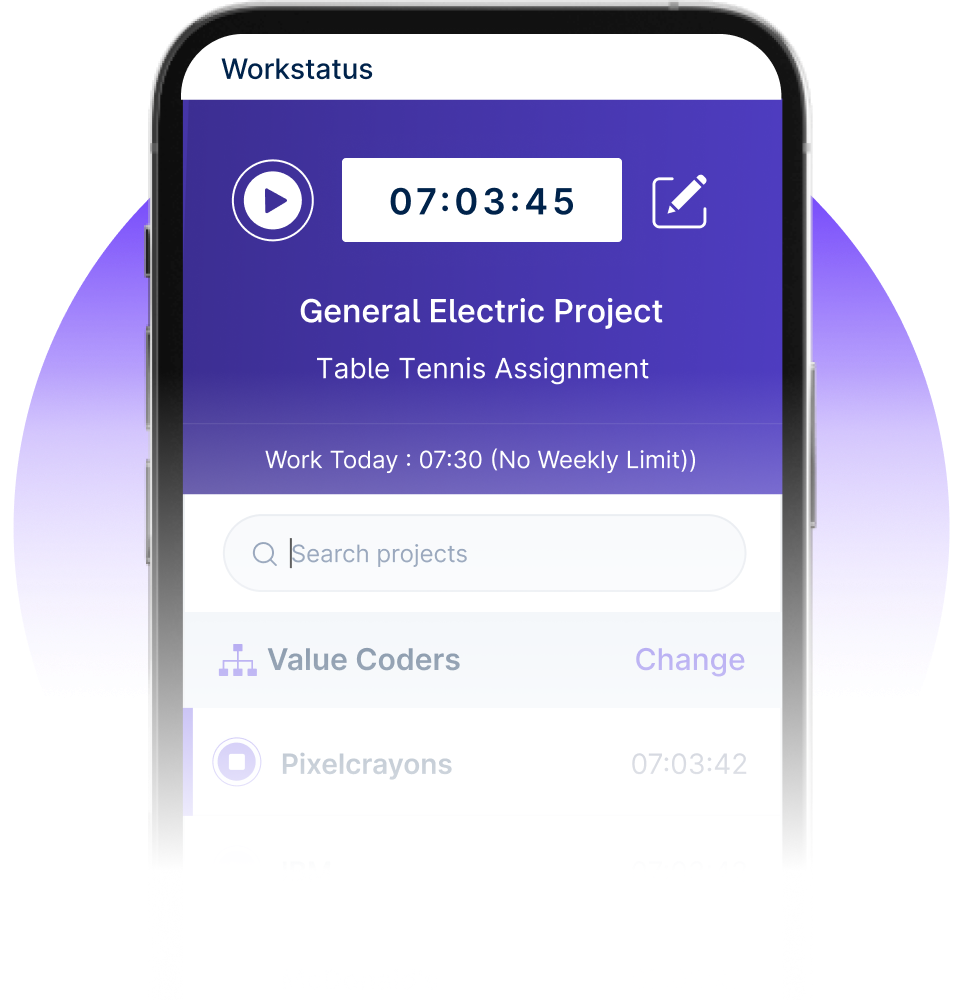

Stay on top of projects with seamless time tracking, task management, and budgeting.

Maximize team output with time tracking, app usage analysis & productivity reports.

Manage unlimited users and projects with no restrictions, perfect for small to mid-sized enterprises.

Ideal for small teams, pay only for the users you need and scale effortlessly.

Unlimited time & attendance tracking for all teams, making it ideal for businesses of any size.

Getting payroll right means collecting the right information from the start.

Payroll management software like Workstatus keeps all the important details organized so you don’t make costly mistakes.

Basic employee information needed:

Work details you need:

Other important information:

When you have complete information before running payroll, employees get paid correctly and on time. Missing details cause delays and upset employees.

Time tracking mistakes create expensive payroll problems that make employees angry and waste your time fixing them.

HR and payroll software identifies these problems before they become costly errors.

Common time tracking problems:

Ways to prevent errors:

Technology helps by:

When your time tracking system talks directly to payroll, there are fewer chances for mistakes to happen.

Manual timesheet approval slows down payroll and creates more chances for errors.

Automated payroll management systems like Workstatus make sure approvals happen on time every time.

Benefits of automation:

Efficiency gains:

Quality improvements:

Automated systems also help with compliance by making sure all required reviews happen before payroll starts.

Connecting time tracking software directly to pay rates eliminates calculations errors and makes sure people get paid correctly.

Automated Time tracking improves accuracy by:

Benefits of automatic rate calculations:

Integration advantages:

When systems automatically match hours to pay rates, payroll becomes more accurate and you get better information about actual labor costs.

Remote teams create payroll problems that traditional systems can’t handle easily. Payroll tracking gets complicated when employees work in different places and time zones.

Location problems include:

Remote work issues:

Administrative difficulties:

These problems need special systems that can handle multi-location complexity while staying accurate and following all rules.

Different places have unique tax and labor rules that must be followed exactly to avoid fines.

Payroll and timesheet software like Workstatus handles these complications automatically.

Regional requirements:

Tax rule automation:

Benefits of automation:

Employee payroll tracker systems that handle regional differences automatically reduce your workload while ensuring you follow all applicable laws.

Detailed reports help solve payroll questions quickly and provide documentation for audits.

Payroll management software creates comprehensive reports that show exactly how pay was calculated.

Essential audit reports:

Dispute resolution reports:

Compliance reports:

Having detailed reports ready speeds up dispute resolution and makes audits much easier. Good documentation protects both your company and employees when questions come up.

Workstatus automates time and attendance tracking to ensure accurate payroll calculations.

With Workstatus, your payroll process becomes faster, easier, and more accurate.

Yes, Workstatus allows you to categorize and track different types of hours clearly.

This transparency ensures that only the right hours are paid or billed.

Absolutely. Workstatus automatically calculates overtime based on your company’s rules.

This ensures employees are fairly compensated and labor law compliance is maintained.

Yes, Workstatus makes it easy to export payroll data for processing or integration.

This flexibility supports smooth integration with your existing payroll tools.

Yes, Workstatus is ideal for managing payroll across multiple locations and work models.

It removes the complexity of managing global or hybrid payroll structures.

Workstatus offers transparent, verifiable records to reduce payroll-related issues.

These features create accountability and reduce conflicts around payment.

Managing your workforce, projects, and reports gets simple & effective.

Managing your workforce, projects, and reports gets simple & effective.

Workstatus is highly rated on Trustpilot for reliability, ease of use, and workforce visibility.

Explore MoreGet detailed and clean activity reports of your team.