Table of Contents

Overtime Pay Calculator: Quick & Clear Pay Insights

The concept of overtime is broadly familiar to the working population across industries. But, its very nuances may vary.

Here are some holistic considerations:

- In some industries and lines of work, overtime is a more prevalent occurrence.

- Employees of the construction, IT, manufacturing, and finance sectors are more frequently observed putting in extra hours.

- Overtime automatically accounts for additional pay.

In literary terms, overtime is additional hours invested by an employee beyond the predefined schedule. To put it simply:

- When employees work past their scheduled hours, it’s overtime.

- It is also an acronym for the payment provided for those extra hours.

Overtime Rules for Businesses

Businesses must comply with labor laws when managing overtime:

- Standard hours are set to maintain employee health and productivity.

- A typical workweek is 40 hours, with additional time counted as overtime.

- Accurate records are required to calculate proper compensation.

- Workstatus time tracking software automates hour logging and ensures compliance.

What Is Time and a Half?

For payroll teams, time and a half is the most common overtime rate:

- Employees earn 50% more than their regular hourly rate for overtime.

- Example: $20/hour becomes $30/hour for overtime.

- Some companies offer double time for weekends or holidays.

- Workstatus allows custom overtime multipliers (1.5, 2.0, etc.) for flexible policies.

Overtime Pay Formulas

Calculating overtime pay becomes simple when broken into clear steps:

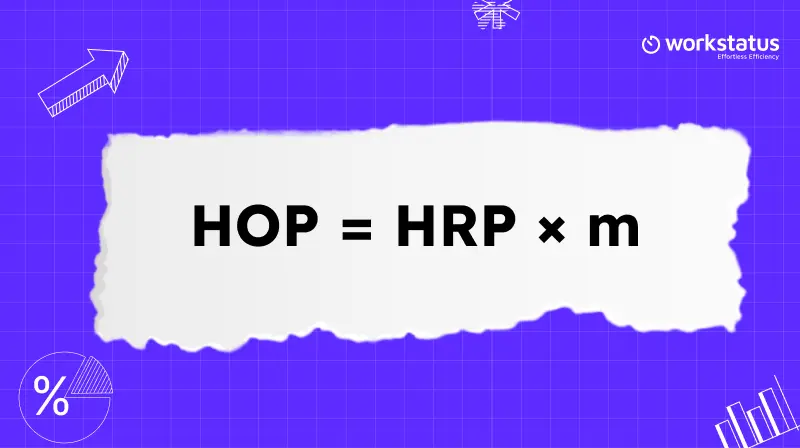

Calculate Hourly Overtime Pay (HOP)

Use the formula:

Where:

- HOP stands for hourly overtime pay,

- HRP is the hourly regular pay,

- m is the overtime multiplier (typically 1.5 for time and a half).

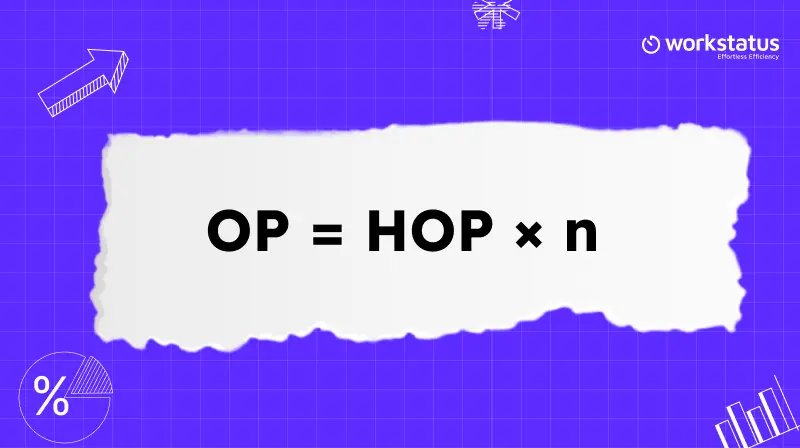

Calculate Total Overtime Pay (OP)

Once you know the hourly overtime pay, calculate total overtime compensation:

Where:

- OP is the total overtime pay,

- n is the number of overtime hours in a month.

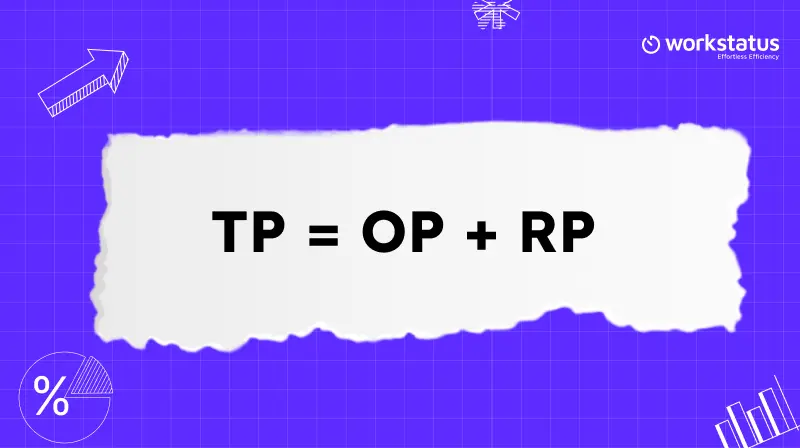

Calculate Total Monthly Pay (TP)

Finally, determine the total salary including regular and overtime pay:

Where:

- TP stands for total pay,

- RP is the regular pay, which equals the hourly regular pay multiplied by the total number of regular working hours in a month.

With the overtime pay calculator, these steps are automated, ensuring accurate payroll without manual effort.

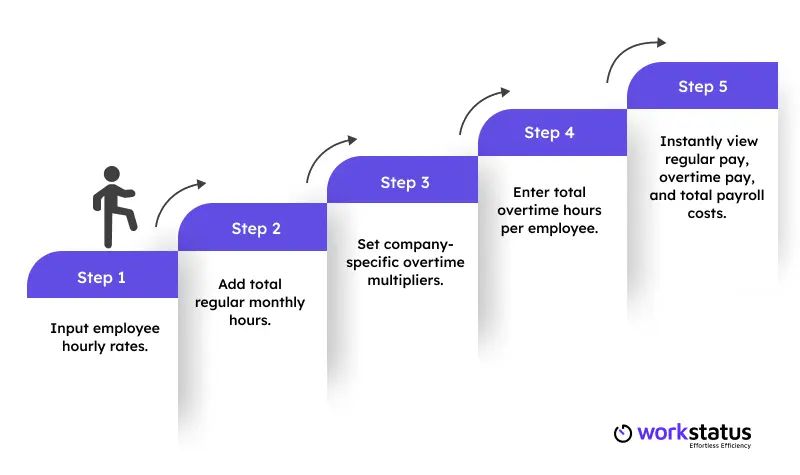

How to Calculate Overtime Pay?

Using Workstatus, payroll managers can:

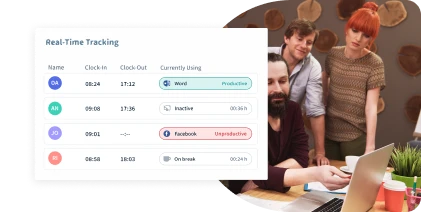

With automated workforce tracking, Workstatus records all employee hours in real time.

Exemptions from Overtime Pay

Some roles are exempt from overtime compensation due to their job nature and salary structure.

Examples of exempt corporate roles:

- Executives and senior managers.

- Department heads and team leaders.

- HR directors and payroll supervisors.

- Senior software architects and IT strategists.

- Strategy consultants and high-level analysts.

Workstatus allows employers to configure different pay structures for exempt and non-exempt employees.

Why Use Workstatus for Overtime Management?

Workstatus helps businesses handle overtime efficiently:

- Smart time tracking for accurate work-hour records

- Workforce management tools for real-time oversight

- Attendance and shift monitoring to avoid disputes

- Ready-to-use overtime reports for payroll processing

These features reduce administrative effort while ensuring accurate and compliant payroll calculations.

Final Thoughts

For businesses that allow employee overtime, the overtime calculator is a must-have for transparent and efficient payroll management.

It ensures accuracy, compliance, and simplicity, helping SMBs manage overtime costs without errors.