Experience the Power of Productivity

Make your team 40% more efficient. Set up your account in just 2 minutes!

Variability in compliance reporting processes often results in incomplete or inaccurate records, complicating audits and assessments.

Dependence on manual entry and reporting introduces errors, delays, and inefficiencies in compliance management for field teams.

Different security practices across departments can leave gaps in data protection. This makes you vulnerable to breaches and compliance issues.

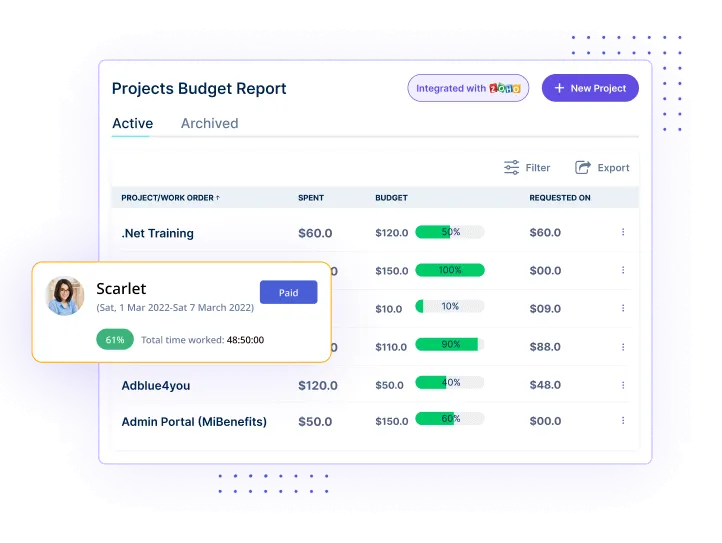

Manage and monitor compliance across your organization from a central platform, ensuring consistent adherence to regulations.

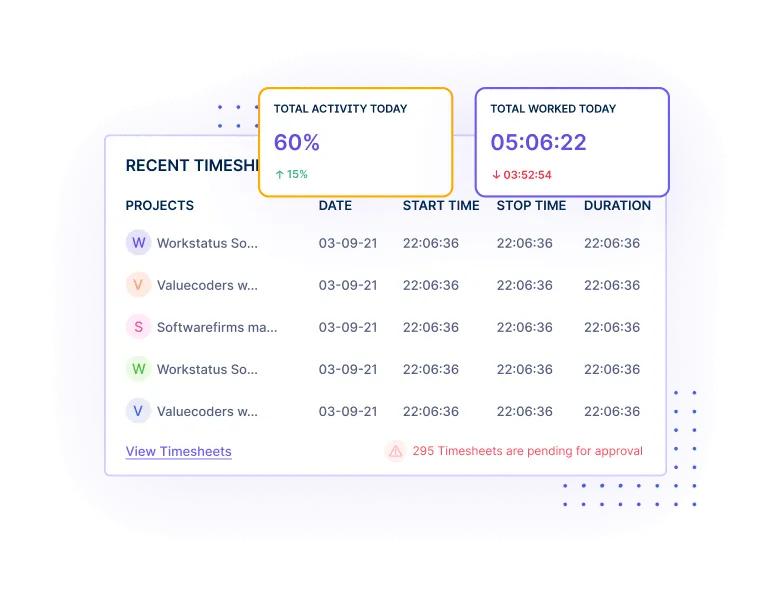

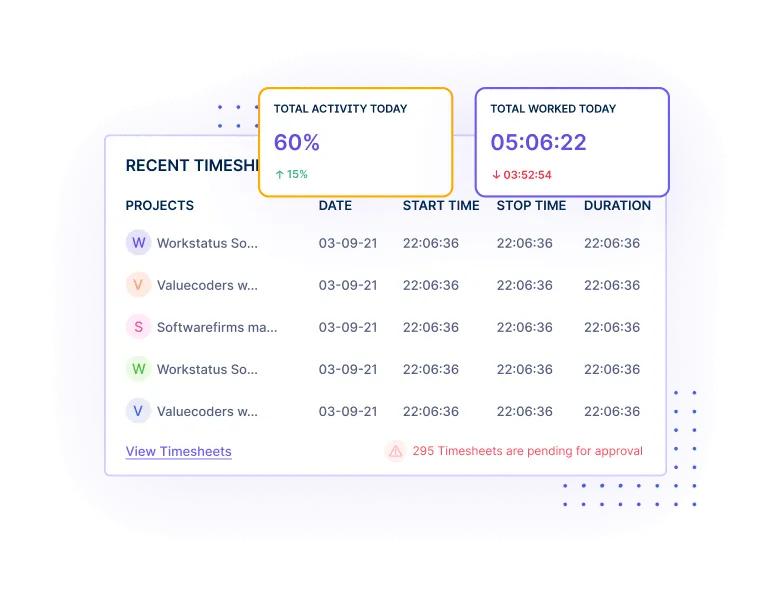

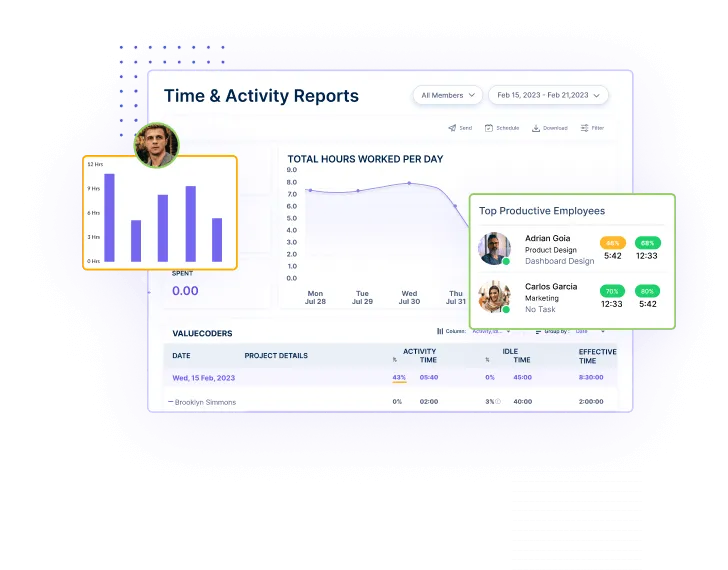

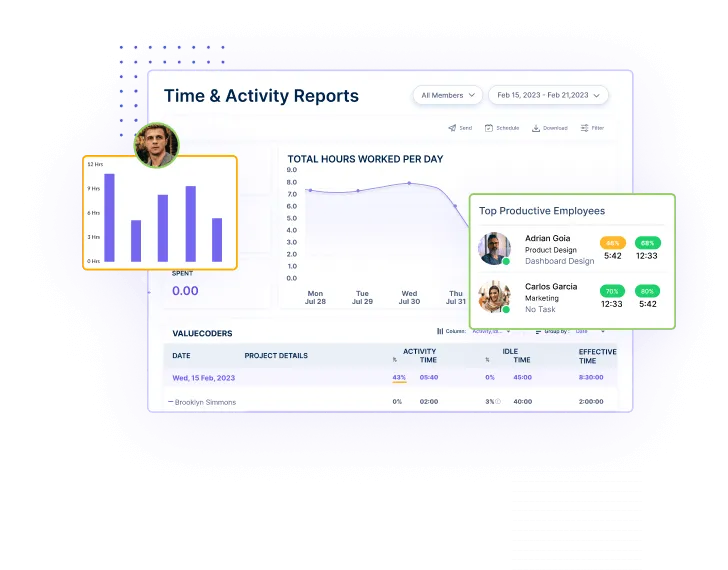

Workstatus automated system continuously monitors employee activity, flagging potential compliance issues for prompt resolution.

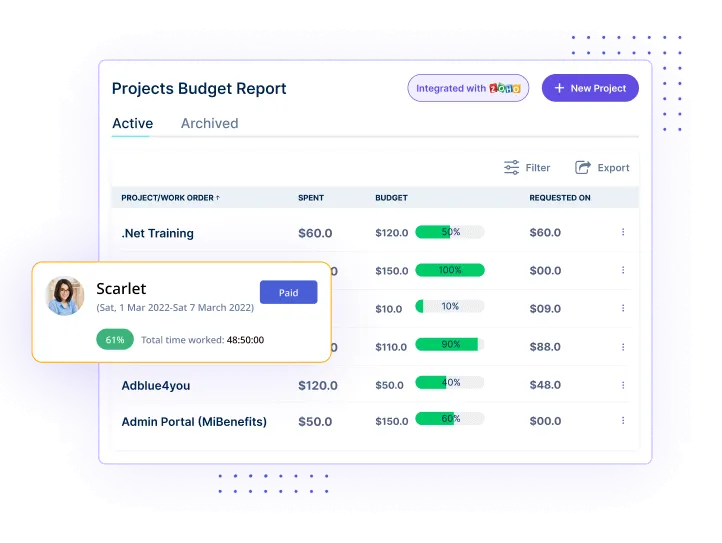

Speed up the audit process by automating the collection and analysis of compliance data, reducing manual effort.

Generate up-to-date compliance reports anytime, providing a clear view of your organization’s regulatory status for internal reviews or external audits.

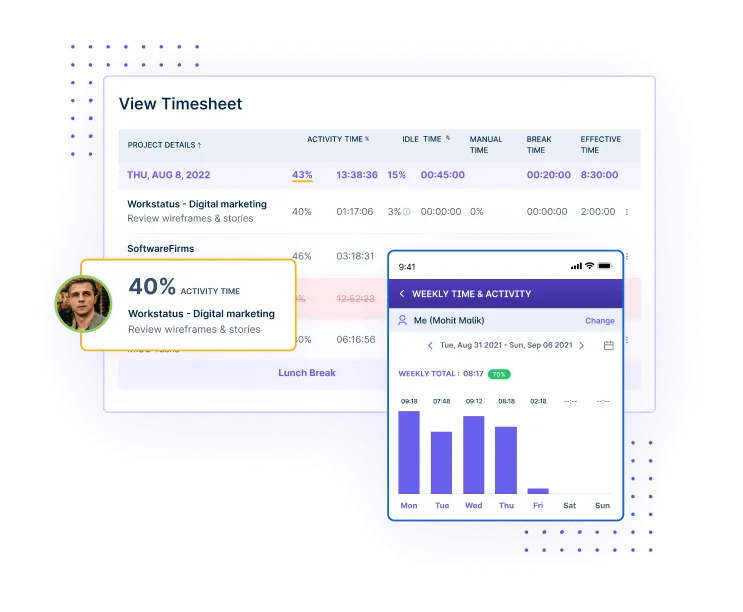

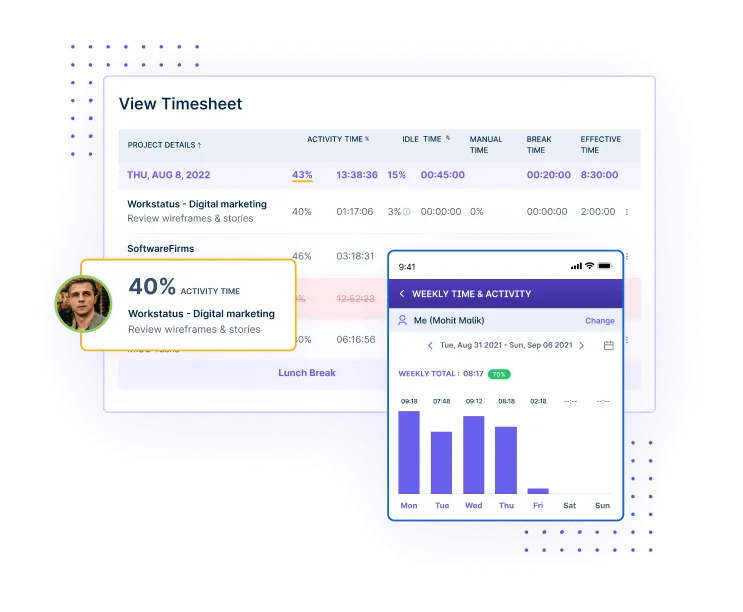

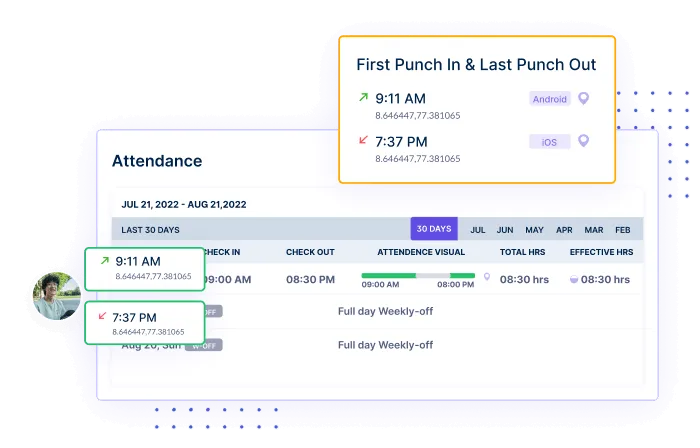

Simplify compliance for field teams to ensure consistent adherence to regulations while on the go. Enhance efficiency and reduce errors with easy-to-follow compliance steps.

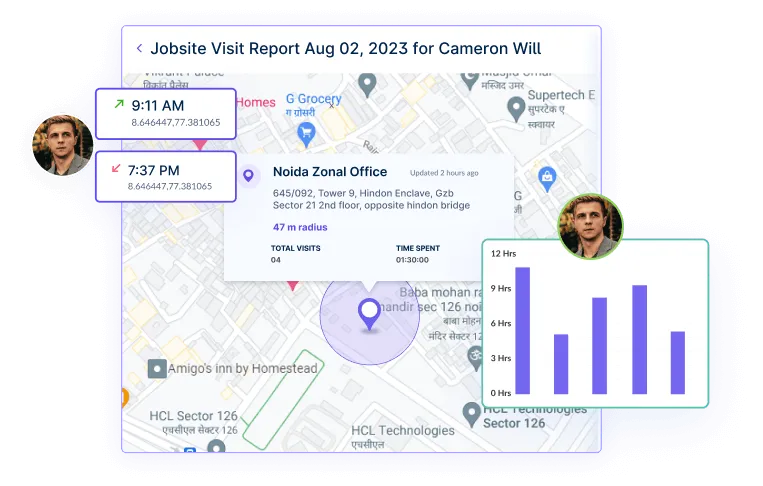

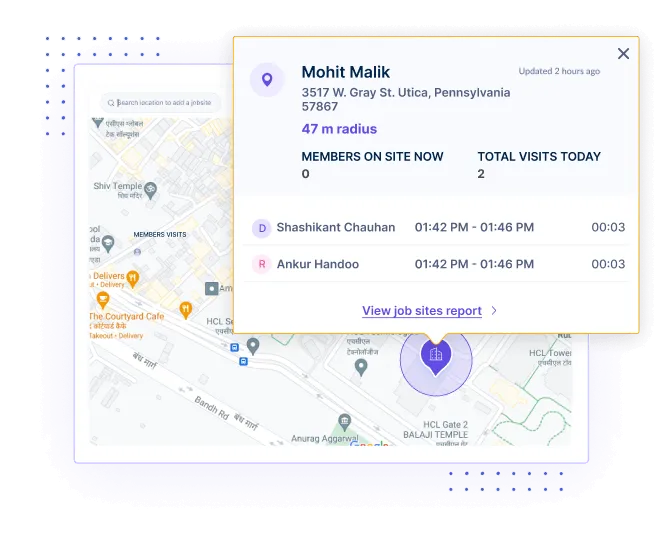

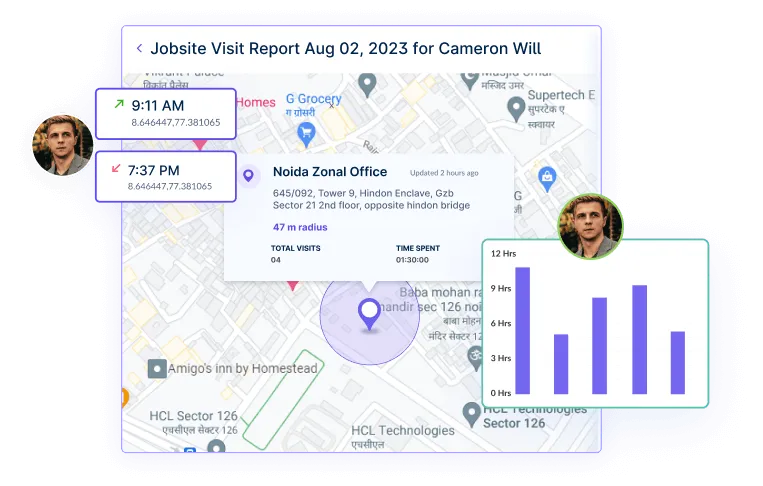

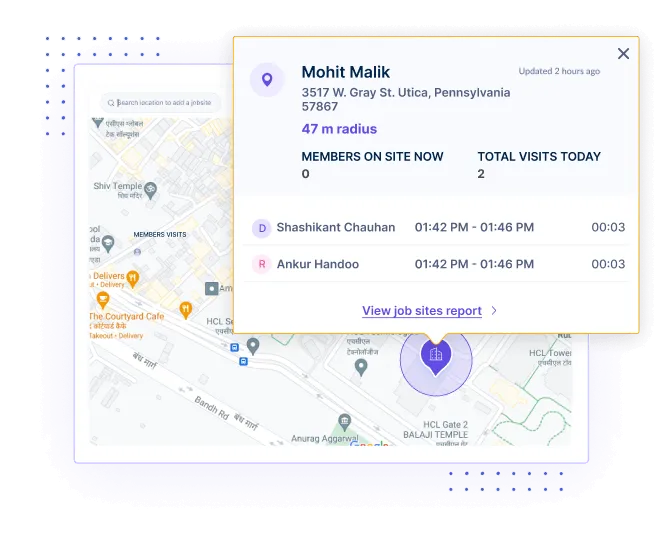

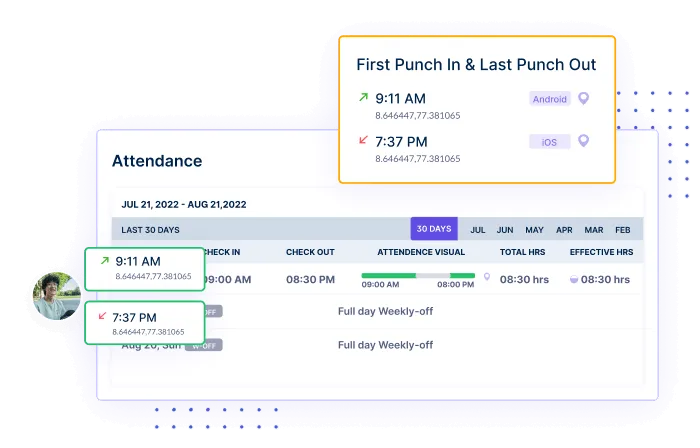

Ensure compliance with location-based regulations through automated GPS tracking, which verifies employees’ real-time locations during work hours.

Geofencing technology within Workstatus helps enforce location-based regulations, ensuring employees work where they should.

Maintain accurate, organized location records that are easily accessible, ensuring you are always ready for regulatory reviews.

Implement strong measures and policies to protect sensitive information across the workplace. Maintain a secure environment with consistent practices for all employees.

Ensure compliance with data protection laws, such as SOC 2 Type II, PCI-DSS, and ISO 22301 to safeguard user privacy and avoid regulatory penalties.

Workstatus helps you implement robust security measures to protect sensitive data from unauthorized access and breaches.

Continuously track and review data access and usage to ensure compliance, prevent unauthorized actions, and maintain data integrity.

Our lightweight app allows you and your team to track time, no matter where you are. With GPS tracking and geofencing, anyone can clock in automatically when they enter a job site or get reminders based on location.

Workstatus account required to use apps

Compliance Tracking is crucial for businesses to ensure they meet legal requirements, maintain transparency, and avoid potential penalties or legal issues.

Workstatus utilizes advanced technology to monitor and analyze various compliance parameters, generating real-time reports and alerts to help businesses stay compliant.

Yes, Workstatus prioritizes data security and follows strict encryption and security protocols to protect sensitive compliance data.

Workstatus can be tailored to your industry’s unique compliance requirements, ensuring it aligns with your business’s needs.

The benefits include improved compliance adherence, reduced compliance-related risks, enhanced data security, and increased operational efficiency.

Track time and productivity effortlessly.

Customized Solutions for Maximum Productivity