Table of Contents

Overtime- the extra hours we invest in our work—can be both a boon & a bane.

For employees, it often translates to increased income & an opportunity to demonstrate dedication.

On the other hand, employers rely on overtime to meet project deadlines & enhance productivity.

Yet, managing overtime efficiently can be complex, requiring precision & adherence to labor laws.

In this blog, we’ll introduce you to the ultimate solution for overtime management, the Overtime Calculator, unveiling its incredible benefits, functionality, & how it can revolutionize how you approach your work & finances.

What Is Overtime?

Overtime refers to the additional hours an employee works beyond their regular working hours or beyond the standard 40 hours per week in many countries.

It’s typically compensated at a higher pay rate, often called an “overtime rate,” which is usually 1.5 times the regular hourly wage.

Laws & Regulations With Overtime:

1. Fair Labor Standard Act (FLSA) – United States

- The FLSA states that non-exempt employees in the United States are entitled to overtime pay at a rate of 1.5 times their regular hourly wage for all hours worked beyond 40 hours in a workweek.

- It sets a federal minimum wage & establishes overtime regulations for employees covered by the act.

2. European Working Time Directive – European Union

- This directive applies to EU member states & limits the average working week to 48 hours, including overtime, over a reference period.

- It ensures a minimum daily rest period & a minimum weekly rest period & limits excessive night work.

3. Australian Fair Work Act

- In Australia, overtime regulations vary by industry & occupation, but the Fair Work Act generally makes overtime pay for working outside standard hours.

- The Act includes provisions for maximum weekly working hours, rest breaks, & compensation for overtime work.

Read More: Demystifying Overtime Taxation: What You Should Know

Overtime Calculation Methods

1. Determine the Regular Hourly Rate

Calculate the employee’s regular hourly rate by dividing their weekly or monthly salary by the standard number of hours in a workweek (e.g., 40 hours).

2. Identify Overtime Hours

Determine the total hours worked in a given workweek. Any hours exceeding the standard workweek (e.g., 40 hours in the United States) are considered overtime hours.

3. Calculate Overtime Pay

Multiply the number of overtime hours by the overtime rate. In most cases, this rate is 1.5 times the regular hourly rate.

Example:

- An employee’s regular hourly rate is $20 per hour.

- They work 45 hours in a workweek.

- Overtime hours worked are 45 – 40 = 5 hours.

- Overtime Pay = 5 hours x $20/hour x 1.5 = $150

In this example, the employee would receive an additional $150 for the 5 hours worked beyond their standard workweek.

Common Causes Of Overtime

- Deadline Pressure

Projects with tight deadlines often require employees to work extra hours to meet time-sensitive goals.

- Staff Shortages

Insufficient staffing can increase workloads, forcing employees to work extra hours.

- Unplanned Workload

Unexpected tasks or urgent issues can disrupt regular work schedules & result in overtime.

- Inefficient Processes

Inefficient work procedures & lack of automation can slow down productivity, necessitating extra time.

- Client Dem&s

High-maintenance clients or customers may require additional attention & work hours.

These are some common causes of overtime, but regardless of the reason, employers & employees need to track & manage overtime hours & compensation accurately. & this is where the Overtime Calculator comes in.

Benefits Of Using The Overtime Calculator

1. Efficiency

The Overtime Pay Calculator eliminates the need for manual calculations or reliance on potentially inaccurate tools. This saves time & reduces errors, ensuring employees receive fair compensation for overtime hours.

2. Compliance

With its precise calculations, the Overtime rate Calculator ensures compliance with labor laws in various countries. It considers local regulations & applies them accurately to determine proper overtime pay.

3. Transparency

The calculator’s transparent calculations promote trust & fairness between employers & employees by providing a clear breakdown of the calculations used.

Now that we’ve explored the common causes of overtime, let’s delve into how you can efficiently calculate & manage overtime using the Workstatus Overtime Calculator.

What Is Workstatus Overtime Calculator?

Workstatus Overtime Calculator is a free online tool that helps you calculate overtime pay for both hourly & salaried employees.

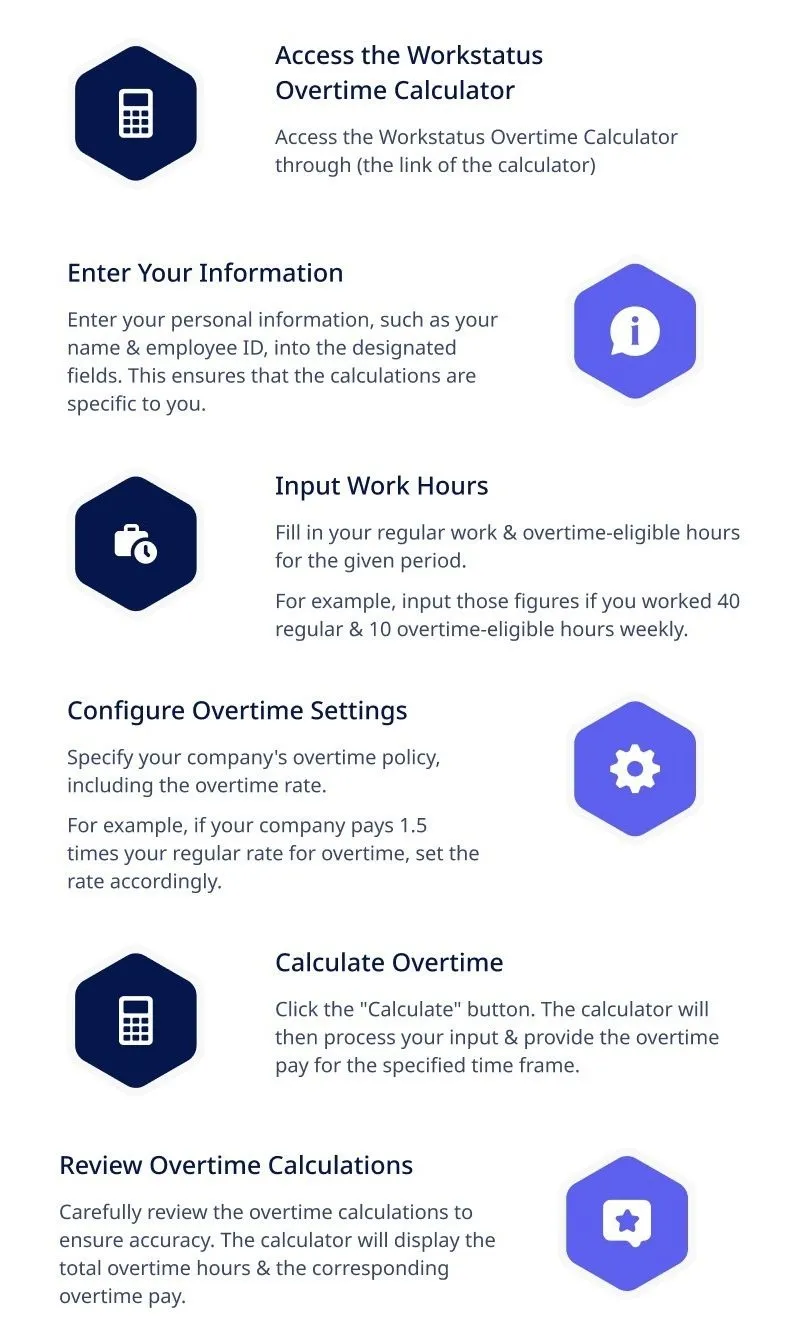

To use the Workstatus Overtime Pay Calculator, simply follow the following steps: Here is an example for a better understanding

Suppose you worked 40 regular hours at $20 per hour & 10 overtime-eligible hours at 1.5 times the regular rate. You’d input:

- Regular Hours: 40

- Overtime-Eligible Hours: 10

- Overtime Rate: 1.5 (indicating 1.5 times the regular rate)

Upon calculating, the tool will show you have 10 hours of overtime & $300 in additional overtime pay (10 hours x $20 x 1.5).

When it comes to using the Workstatus Overtime Calculator, it’s not just about the basic calculations.

The tool has many features that can significantly enhance your overtime management & productivity. Let’s explore how to make the most of these features.

Also check: Free online timesheet calculator

Making the Most of Workstatus Overtime Calculator Features

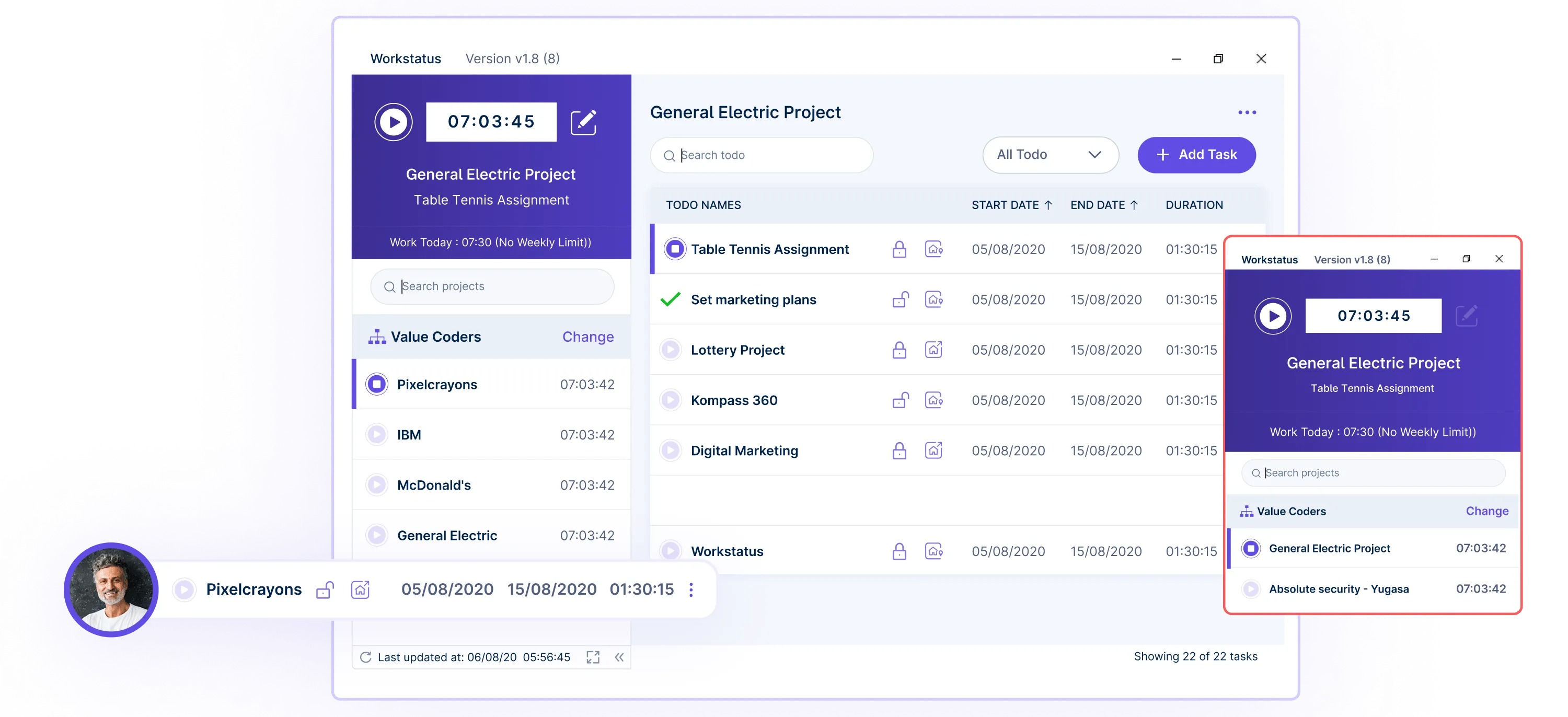

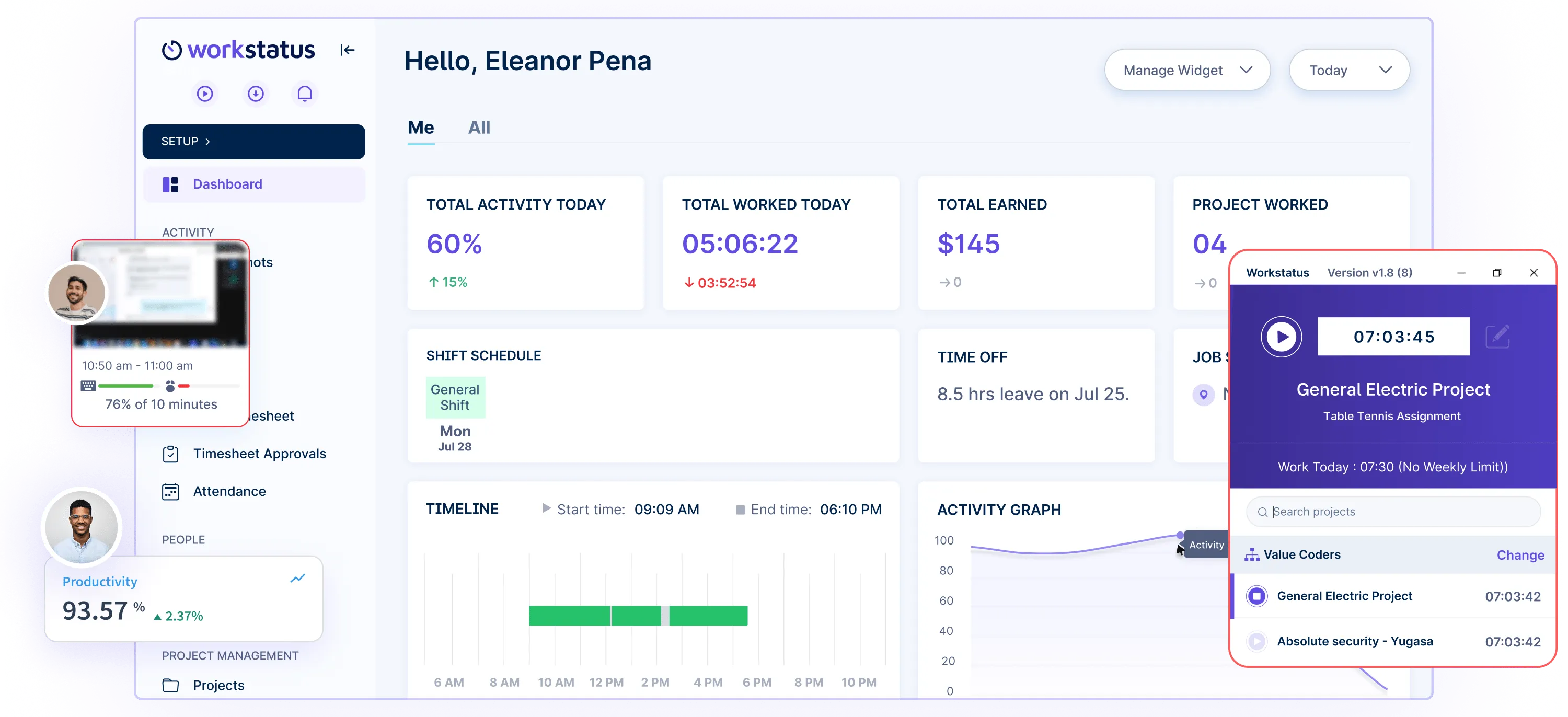

1. Accurate Time Tracking

Key Benefit:

Accurate time tracking with Workstatus allows you to precisely record the hours employees work, ensuring fair compensation & labor law compliance.

How to Use It:

- Log in to the Workstatus.

- Access the time tracking feature within the application.

- Have employees or contractors use the integrated time-tracking tools to record their work hours.

- Ensure they accurately start & stop the timer for each task or project they work on.

Why It Matters:

- Fair Compensation

When employees track their work hours accurately, they are compensated fairly for their time. This promotes job satisfaction & reduces potential disputes over wages.

- Legal Compliance

Labor laws often require employers to pay overtime for hours beyond the standard workweek. Accurate tracking helps ensure compliance with these laws & avoids legal issues.

2. Employee Productivity Monitoring In Overtime

Key Benefit:

Workstatus includes employee productivity monitoring during overtime, offering insights into how efficiently employees use their extra hours.

How to Use It:

- Access the productivity monitoring feature dashboard in the Workstatus.

- Review productivity data for employees who have worked overtime hours.

- Analyze productivity metrics, such as task completion rates & quality of work during overtime.

Why It Matters:

- Quality Control

Monitoring allows employers to maintain the quality of work during extended hours, ensuring that work standards are met.

- Employee Well-Being

Ensuring employees are not overburdened or experiencing burnout is crucial for maintaining their job satisfaction & well-being.

Workstatus’s productivity monitoring feature is a valuable tool for businesses aiming to maximize their employees’ overtime hours by optimizing productivity & maintaining a healthy work environment.

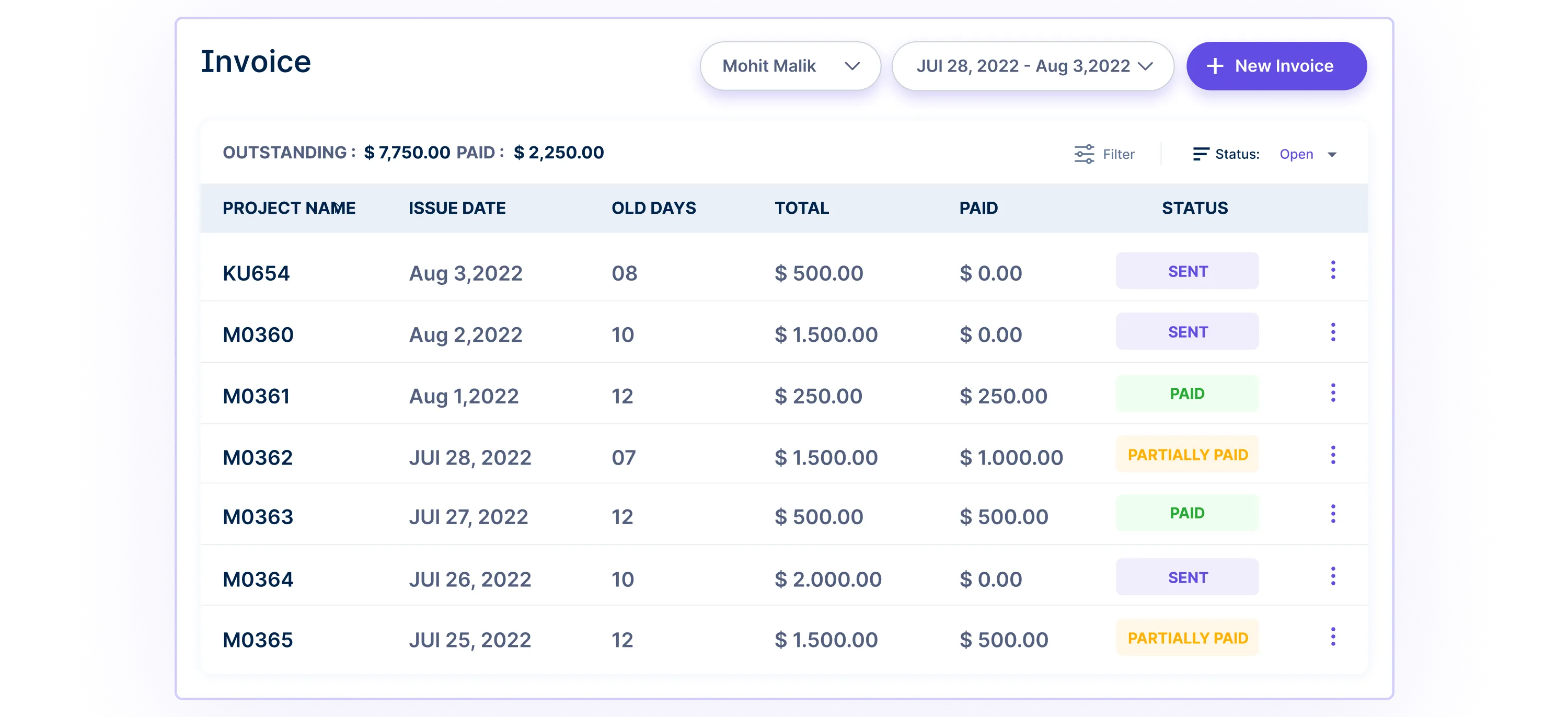

3. Accurate Payroll & Invoicing

Key Benefit:

Workstatus offers real-time payroll & invoicing capabilities, allowing immediate & accurate financial transactions based on tracked work hours.

How to Use It:

- Configure the real-time payroll & invoicing settings within the Workstatus

- As employees track their work hours in real-time, payroll & invoicing systems are updated automatically.

- Verify & approve payroll & invoices for disbursement.

Why It Matters:

- Timely Payments

Employees receive their pay promptly, improving job satisfaction & reducing financial stress.

- Compliance

Adherence to labor laws & financial regulations is easier to maintain when payroll & invoicing are synchronized with tracked work hours.

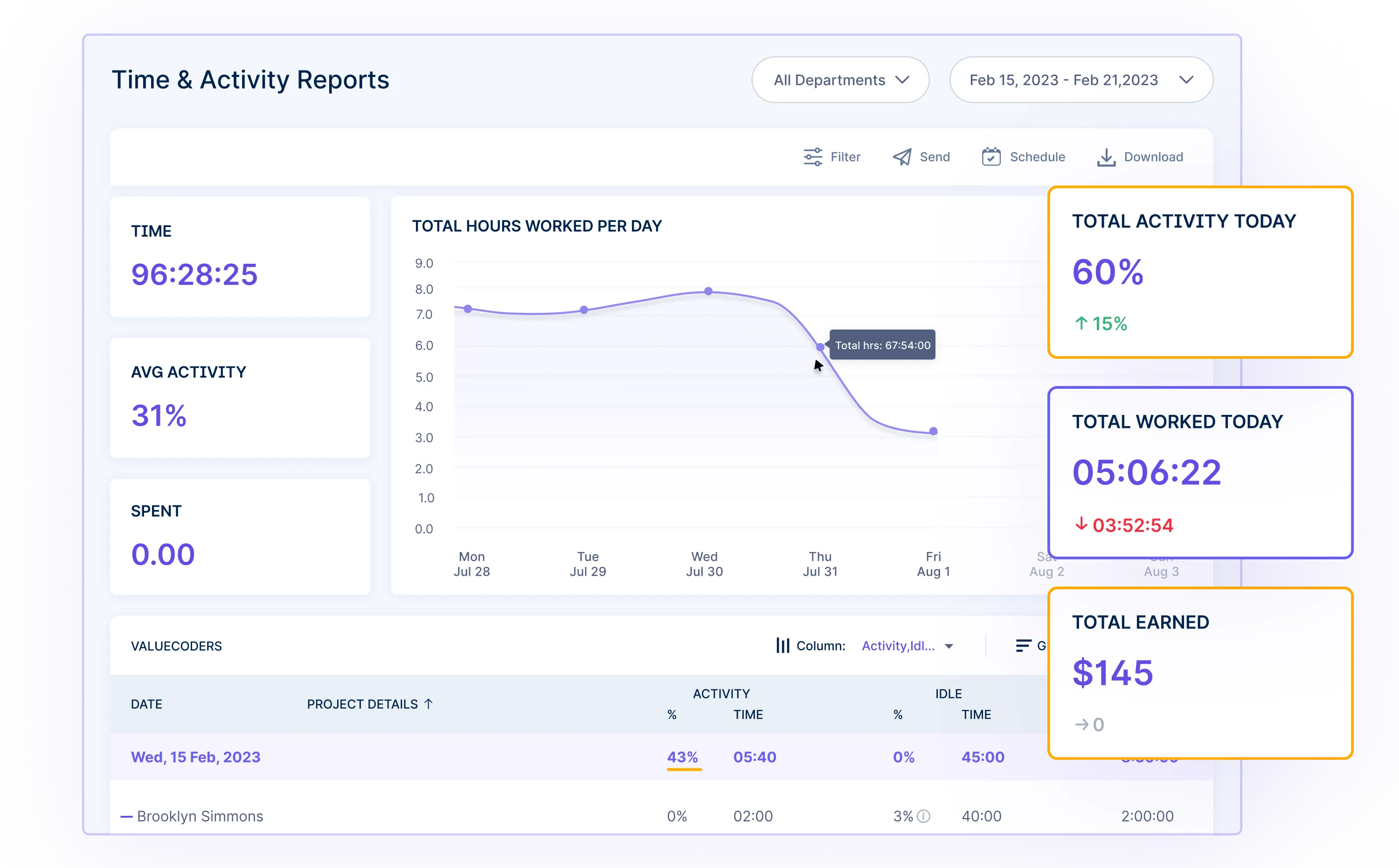

4. Reporting & Analytics

Key Benefit:

The Workstatus provides robust reporting & analytics tools, providing valuable insights into work hours, overtime & employee productivity.

How to Use It:

- Access the reporting & analytics section within the Workstatus Overtime pay Calculator.

- Generate customized reports based on collected data, such as overtime trends, employee performance, & project completion rates.

- Analyze the generated reports to make data-driven decisions.

Why It Matters:

- Data-Driven Decision Making

Analyzing reports helps businesses make informed decisions regarding overtime management, resource allocation, & workforce planning.

- Productivity Improvement

Identifying productivity trends & bottlenecks can lead to process improvements & more efficient use of overtime hours.

- Performance Recognition

Recognizing & rewarding employees who consistently perform well during overtime can boost morale & motivation.

Workstatus’s reporting & analytics capabilities enable businesses to harness the power of data, promoting efficiency, compliance, & overall productivity improvements.

Conclusion

Managing overtime has never been more efficient or data-driven.

Workstatus Overtime rate Calculator simplifies calculating overtime & empowers you to optimize productivity.

With real-time payroll, invoicing, & insightful reporting, you can make informed decisions & ensure your workforce is compensated fairly while maximizing productivity while operating overtime.

FAQs

Ques. How to calculate Overtime Rate per hour?

Ans. To calculate the overtime rate per hour, take your regular hourly wage and multiply it by 1.5. For example, if you earn $20 per hour, your overtime rate would be $30 per hour. This rate usually applies to any hours worked beyond 40 hours in a week.

Ques. How to calculate overtime for monthly salary employees?

Ans. To calculate overtime for monthly salaried employees, first divide the monthly salary by 30 to get the daily wage, then divide by the number of work hours per day to get the hourly rate. Multiply the hourly rate by 1.5 (or the applicable overtime rate) and then by the number of overtime hours worked. This gives the total overtime pay.

Ques. What are the two rules for calculating employee overtime?

Ans. There are two primary rules to follow when calculating employee overtime. The first is the “time and a half” rule, where employees must be paid 1.5 times their regular hourly wage for any hours worked beyond 40 in a workweek. The second applies in some regions and involves daily overtime—if an employee works more than 8 hours in a single day, they are typically entitled to overtime pay for the extra hours at the same increased rate.