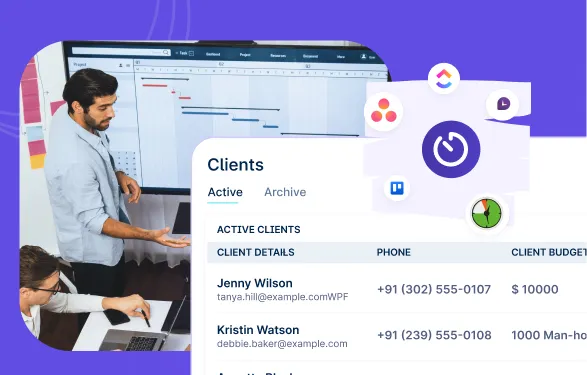

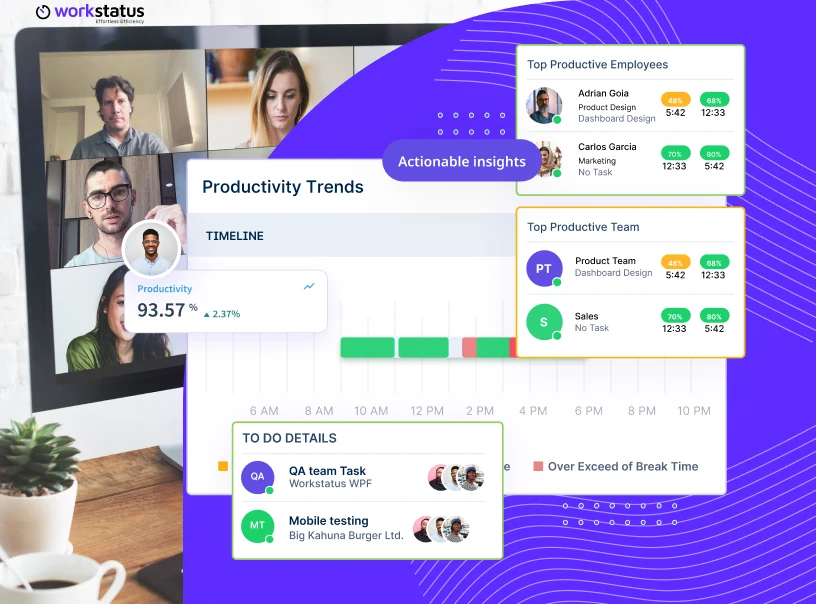

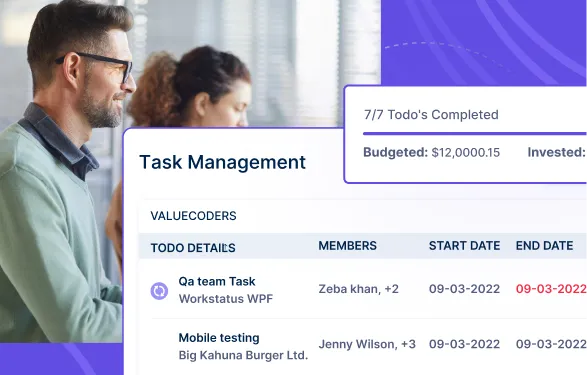

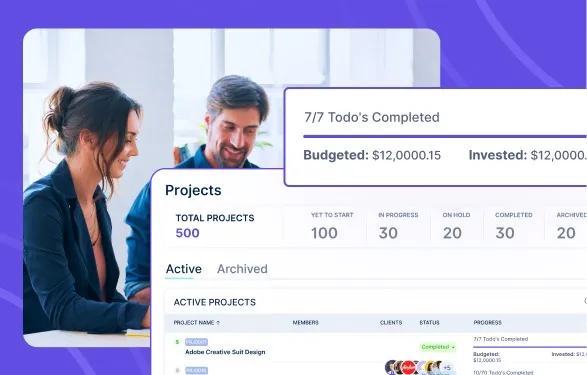

In 2025, businesses are leveraging innovative project management solutions to enhance efficiency and collaboration. This article explores the leading project management software solutions empowering businesses in 2025 to achieve project success. These cutting-edge platforms empower businesses to streamline workflows, enhance collaboration among teams, and effectively track progress towards project goals.