Table of Contents

Introduction

Salaries in India have come a long way over the years.

From an agricultural economy to a tech hub, the nation’s compensation landscape has witnessed significant changes.

Did You Know?

In 2023, the average monthly salary in India is approximately 31,900 INR or 383,000 INR annually, which translates to roughly 387 USD per month based on the June 2023 exchange rate.

This figure, however, doesn’t tell the whole story.

As we delve into this overview, we’ll not only uncover the current salary statistics but also navigate the factors that shape these figures, providing you with a comprehensive understanding of salaries in India and how you can decide the right salary for your employees.

What is the Average Salary in India?

Understanding the average salary in India is crucial for both job seekers and employers alike.

It provides valuable insights into the economic landscape & helps individuals make informed decisions about their career choices and financial goals.

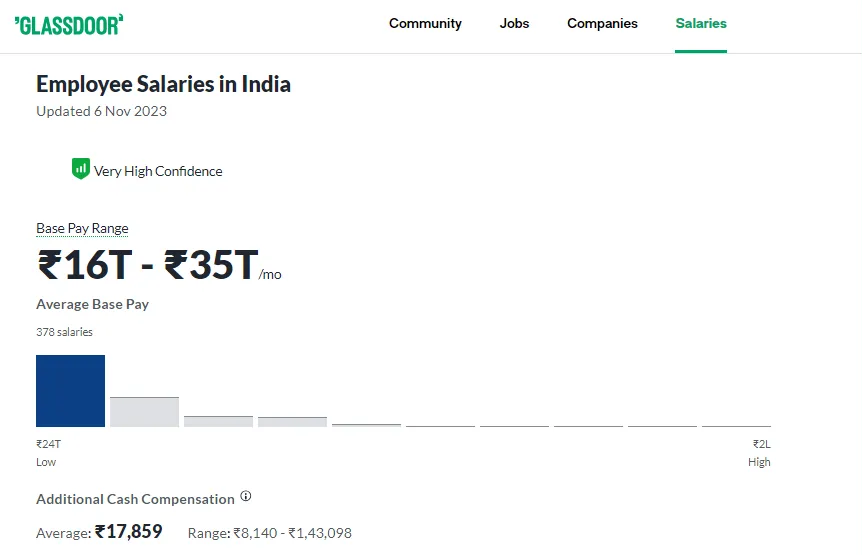

Glassdoor’s Perspective:

In India, the typical monthly salary for an Employee is ₹40,012, and they receive an average additional cash compensation of ₹17,859.

The average salary in India in USD is 385-390 USD per month.

These salary estimates are derived from 378 anonymous submissions by employees on Glassdoor in India.

Salary Explorer’s View

For a broader perspective, Salary Explorer reports India’s national average salary as 387 USD per month, per the exchange rates in June 2023.

This statistic offers an international comparison, enabling individuals to gauge their earnings in the context of the global economy.

These figures serve as an essential reference point for those navigating India’s salary landscape but remember that numerous factors influence individual salaries, making it crucial to consider your unique circumstances.

Recent Trends And Changes In Salaries In India

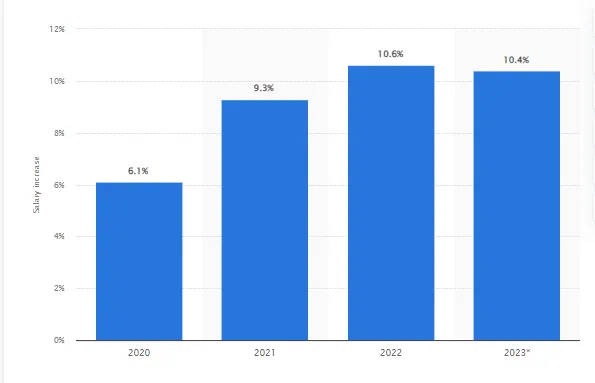

Salaries in India have been subject to various trends and changes in recent years, reflecting the dynamic nature of the country’s economy. Here, we’ll delve into some of the noteworthy shifts and updates shared by Statista.

Growth in Salary (2020-2023):

- From 2020 to 2022, salaries in India exhibited notable growth trends.

- In 2022, the average Indian salary in USD increased by 10.6 percent, surpassing the previous year’s increment by nearly one percent. This exceeded the earlier projection of 9.9 percent made in February.

- While the salary increase for 2022 exceeded expectations, the subsequent year, 2023, was anticipated to witness a slightly lower growth rate of 10.4 percent.

Such trends demonstrate India’s continuously evolving economy, with industries expanding and new job roles emerging, leading to higher salary growth.

Salary Structures In India

Understanding your salary package in India involves grasping its various components, which may include:

- Basic Salary: This is the core of your salary and serves as the foundation for all other components.

- House Rent Allowance (HRA): Provided to cover housing expenses, HRA can be a substantial part of your salary, especially if you live in a rented house.

- Special Allowances: These can vary from employer to employer and may include conveyance, medical, or other allowances.

- Employee Provident Fund (EPF): A mandatory contribution to your retirement fund, usually matched by your employer.

- Gratuity: A lump sum payment made by the employer upon completion of a specified service period.

- Bonuses and Incentives: These can be performance-based or given on special occasions, contributing to your overall earnings.

Tax Implications And Deductions In Indian Salary

Understanding the tax implications and deductions of your salary in India is crucial for effective financial planning.

The Indian income tax system operates on a progressive tax rate structure, which increases as your income rises.

Here’s a breakdown of the income tax rates in India for the assessment year 2023-24: Source

Source

It’s important to note that tax deductions are available for certain investments and expenses, such as those made under Section 80C, Section 80D, and more.

These deductions can significantly reduce your taxable income.

Difference Between Take-Home Salary and CTC

While your salary package often mentions a figure known as CTC (Cost to Company), it’s essential to understand that your take-home salary will be less due to deductions and taxes.

Let’s illustrate this with an example:

Suppose your CTC is INR 10,00,000 annually. Based on the tax brackets mentioned earlier, if your taxable income falls in the 20% bracket, you’ll pay INR 90,000 as income tax.

In this case, your take-home salary would be INR 9,10,000 (CTC minus income tax).

Additionally, if you have any other deductions or contributions, these will also affect your take-home salary. Understanding this difference is crucial for budgeting and financial planning.

Factors Affecting Salaries in India

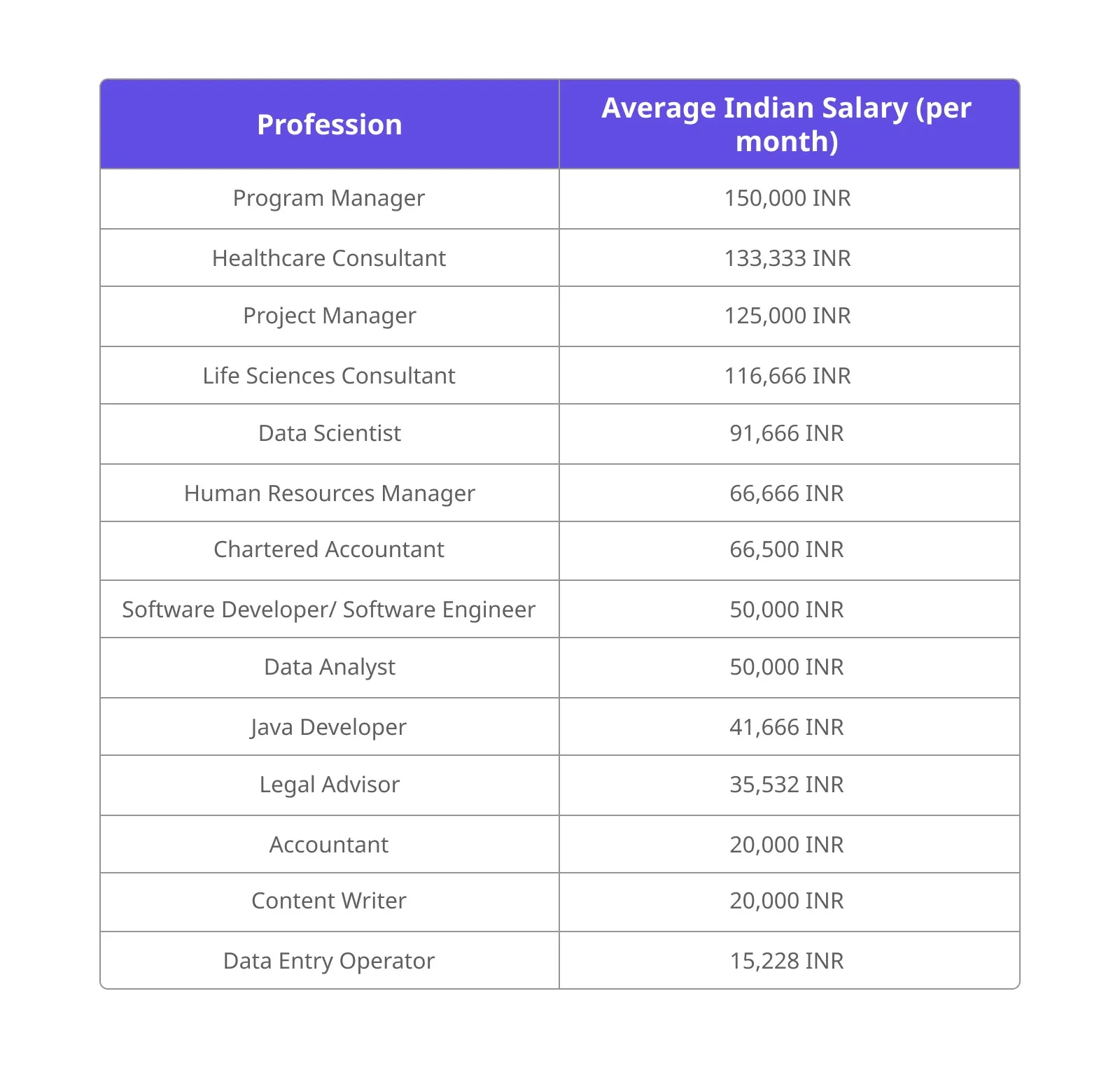

1. Profession and Job Sector

India’s economy encompasses various professions, each with salary standards and growth patterns.

To understand how it differs with varying professions and job sectors, let’s explore the specific data in the following table.

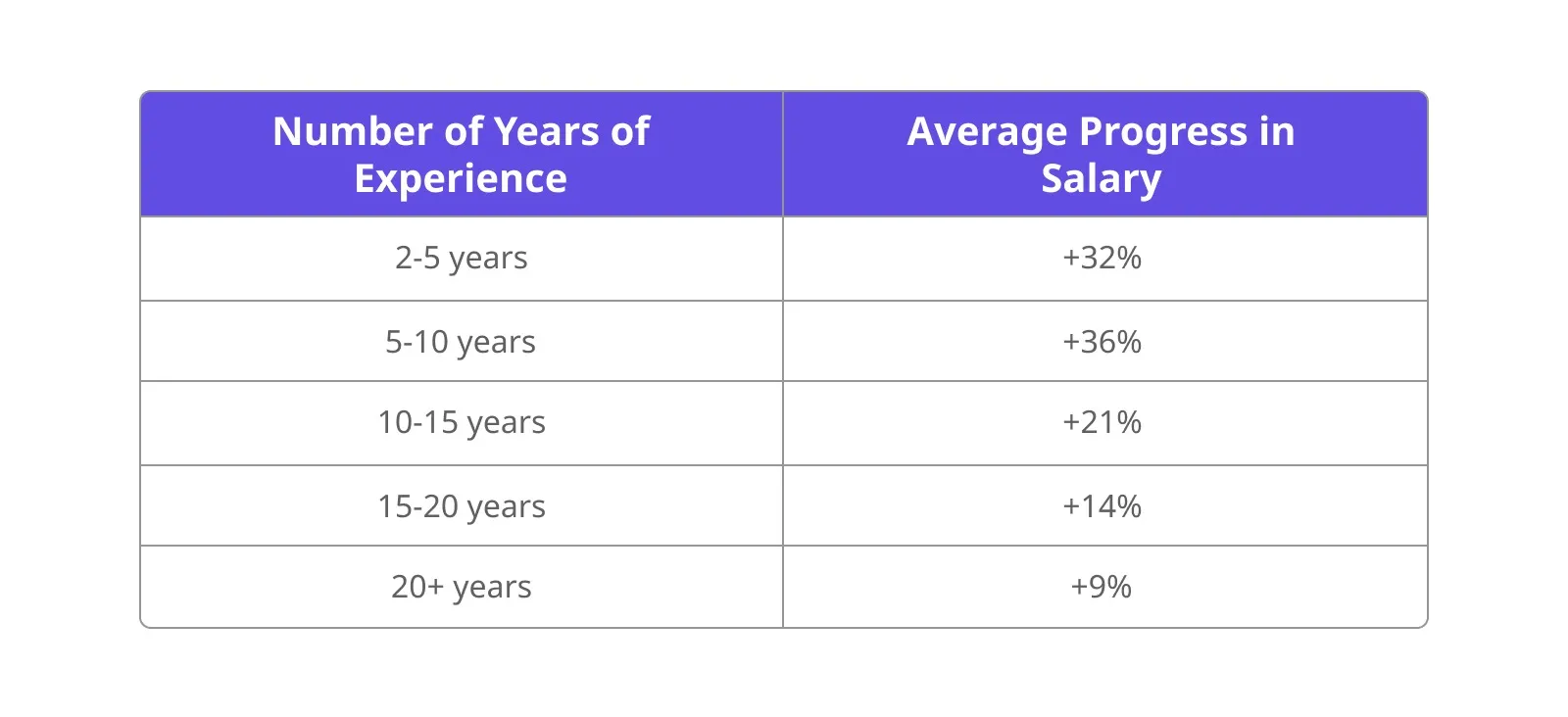

2. Education and Experience

In India, education and experience are key determinants of salary levels. Your qualifications and the years you’ve spent in the workforce significantly impact your earning potential.

The data in the following table provides a comprehensive view of how education and experience influence salaries, offering valuable insights into the importance of continuous learning and professional growth.

3. Location

The geographical location within India can lead to significant variations in salaries. The cost of living, demand for specific skills, and regional economic disparities all contribute to these differences.

Here is the table for varying salaries based on different locations

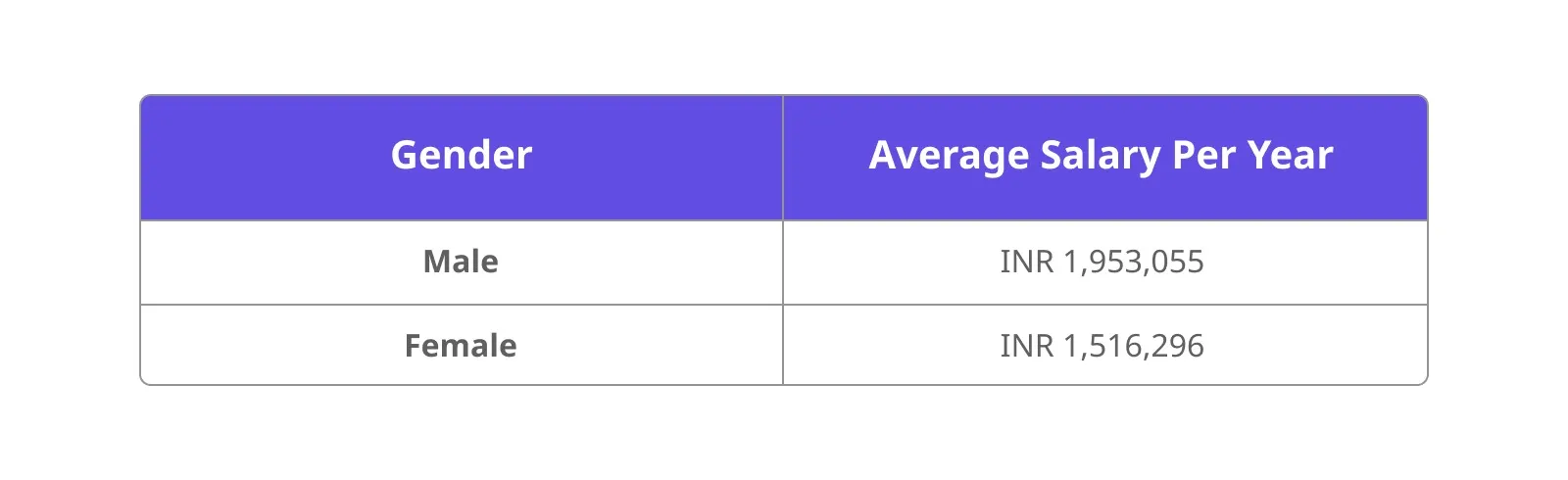

4. Gender Pay Gap

Promoting gender equality in the workplace is a global concern, and India is no exception. The following table presents an overview of the gender pay gap in India for the same job

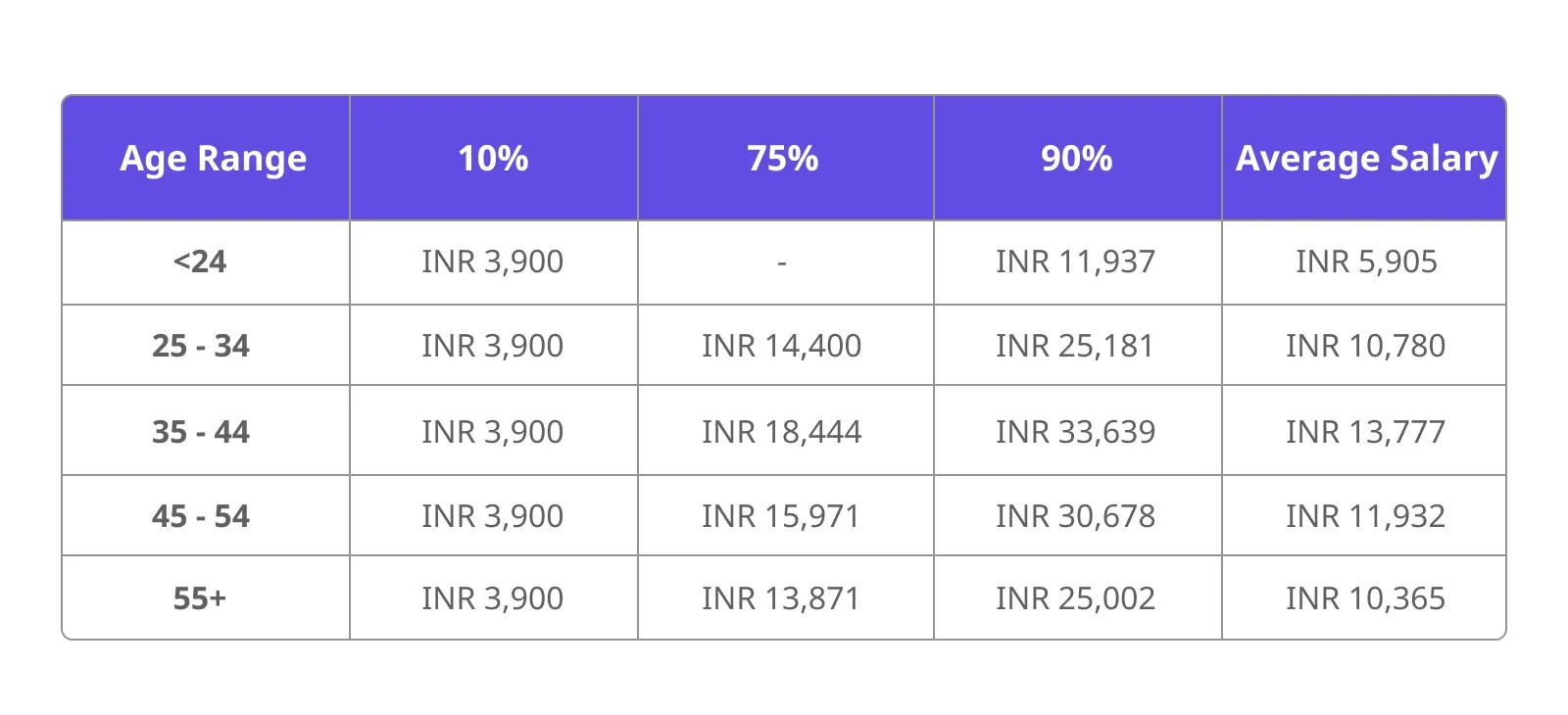

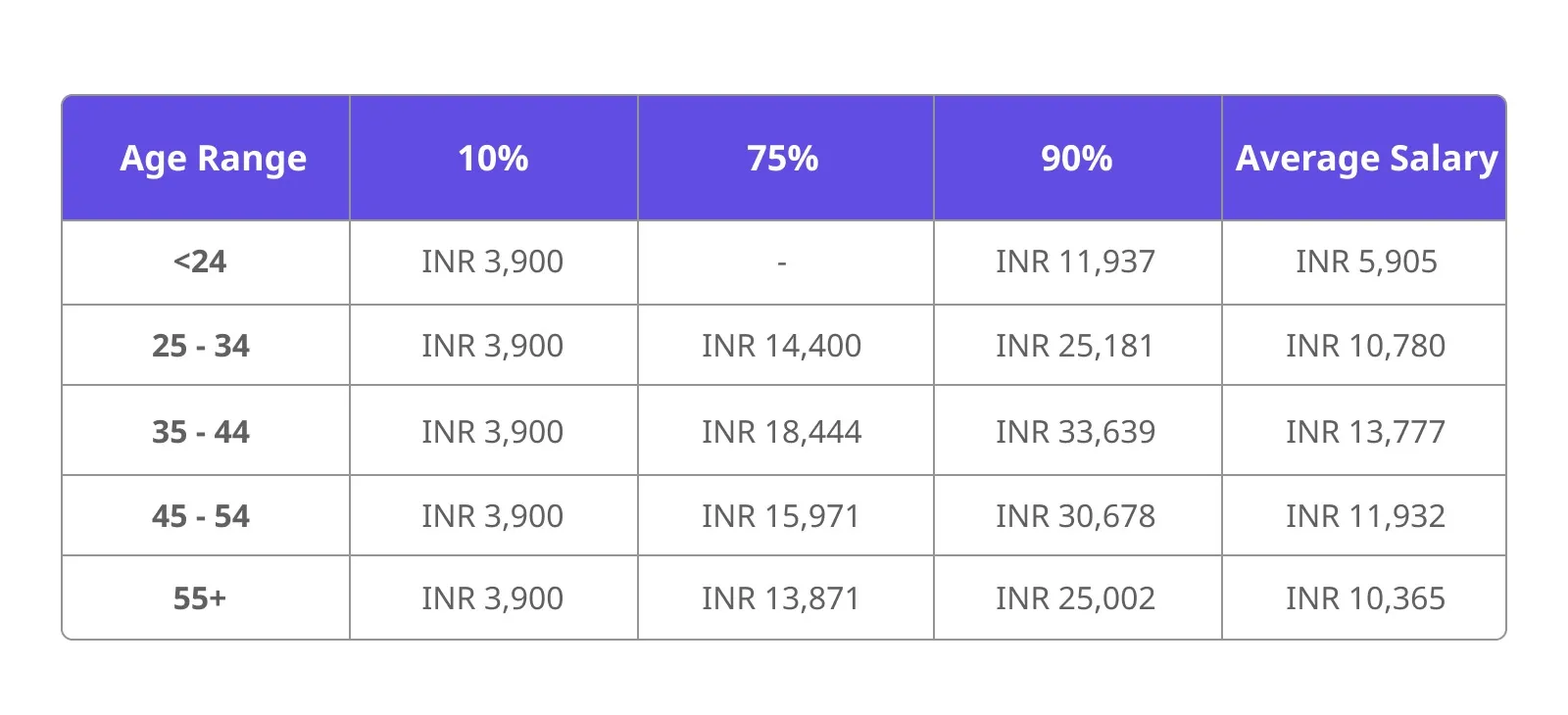

5. Average Salary By Age In India

Salaries often evolve with age and experience. The progression of income throughout one’s career is an essential consideration for both employees and employers. For insights into how salaries change with age, please refer to the following table.

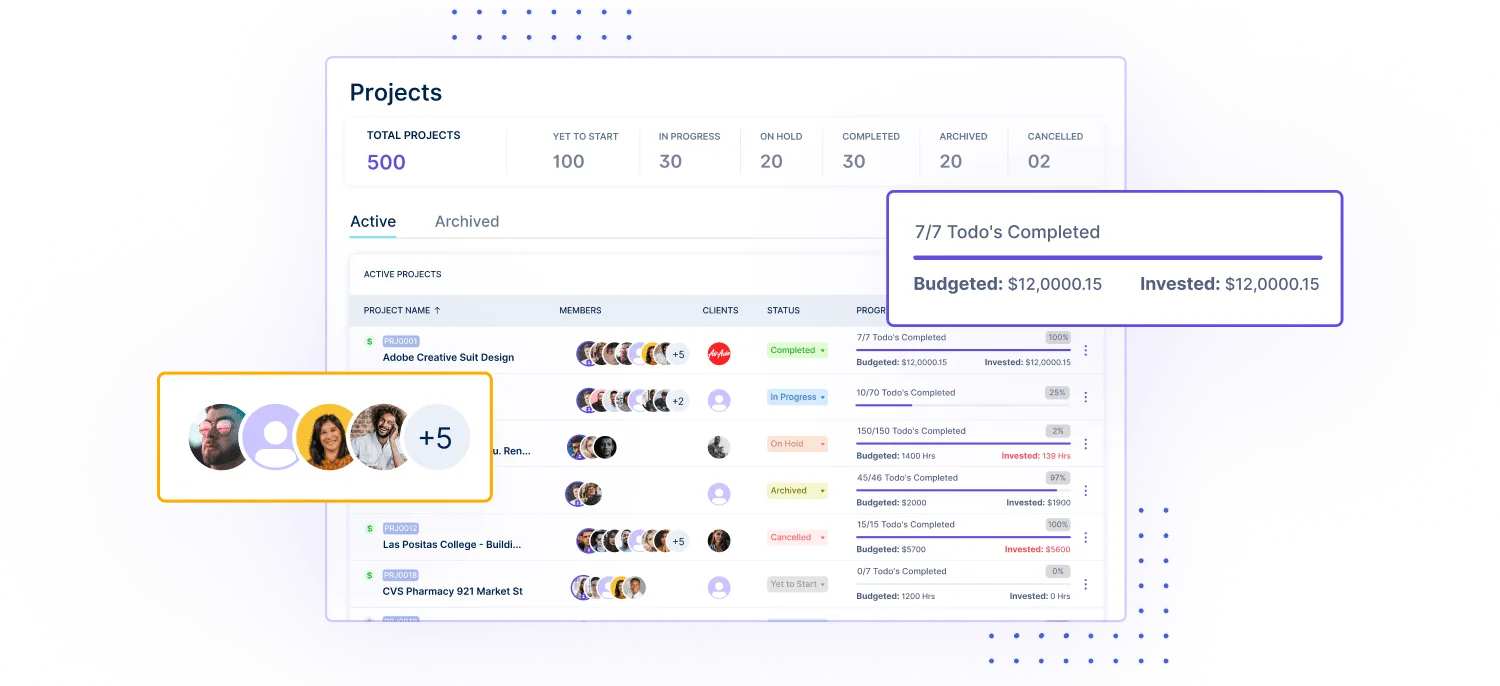

Setting The Right Salary With Workstatus

1. Time Tracking and Productivity Monitoring

Workstatus provides features for tracking employee time and monitoring productivity. It can be instrumental in determining the appropriate salary for your workforce. Here’s a more detailed breakdown:

Time Tracking

Workstatus time tracking feature enables you to monitor how much time employees allocate to various tasks and projects.

You can gain insights into their daily activities, which can be valuable when assessing their contributions to different aspects of your business.

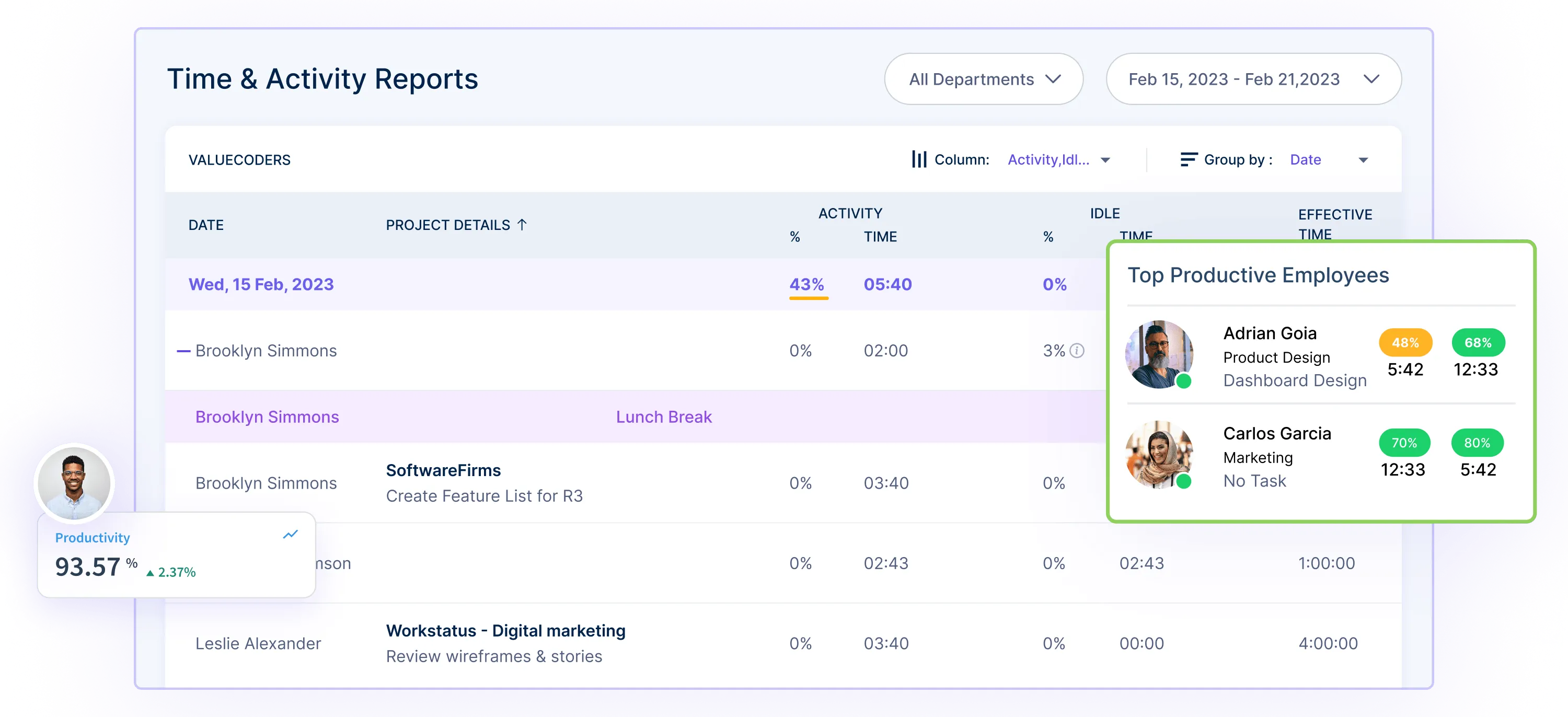

Productivity Monitoring

The productivity monitoring feature helps you evaluate how efficiently your team works. It can track active work hours, idle time, and breaks.

This data is essential for understanding productivity patterns and identifying areas where improvement may be needed.

Project-Specific Tracking

Workstatus allows you to assign specific tasks or projects to employees, making it easier to assess their performance in different areas.

This information is valuable for deciding on bonuses, promotions, or salary increments based on specialized skills and achievements.

2. Performance Tracking

Workstatus performance tracking features offer valuable insights into employee contributions, further assisting in salary determination:

Activity Levels

![]()

Monitor the activity levels of employees to gauge their engagement and dedication to work.

Assess how active they are during their working hours and which sites and apps were used during operations, providing a basis for recognizing high-performing and underperforming employees.

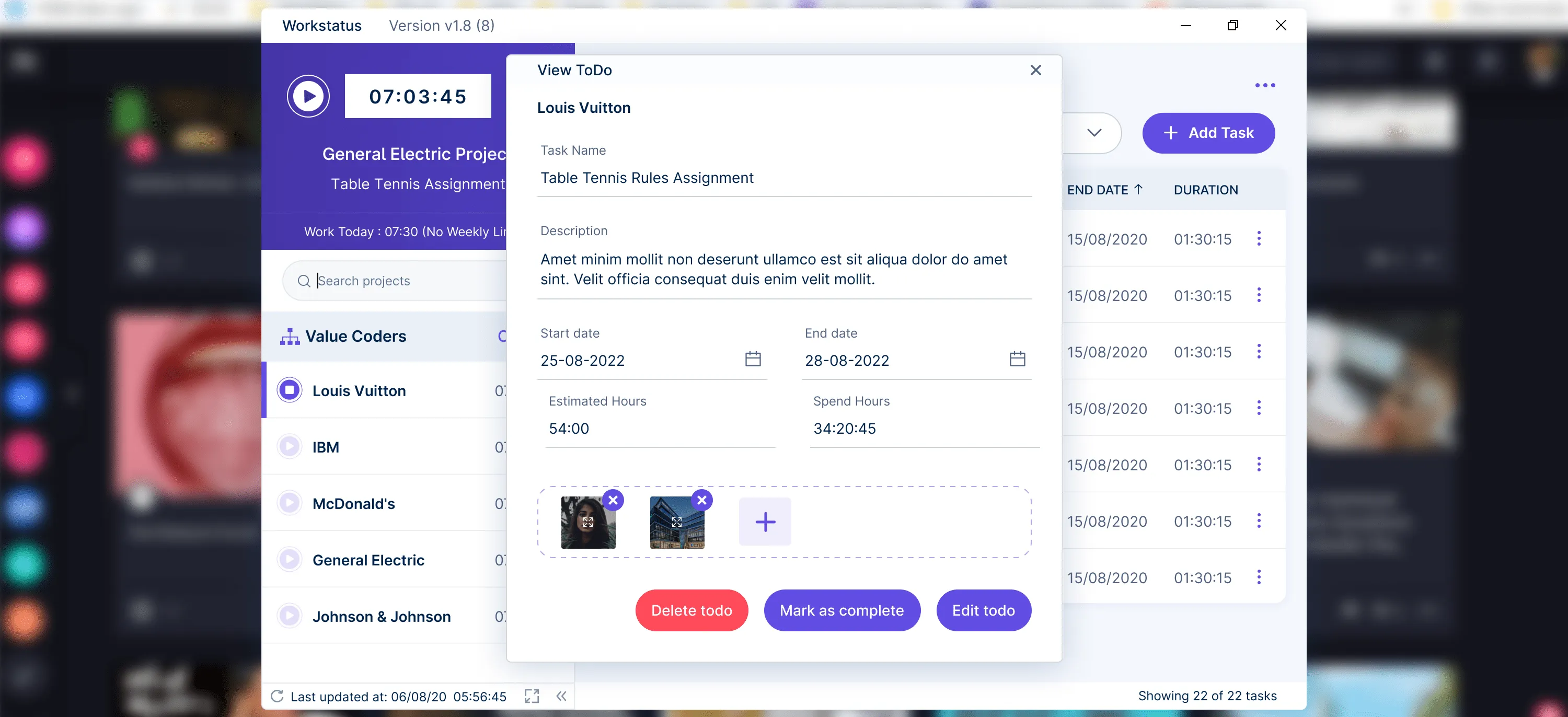

Task Completion

Track the completion of tasks and projects to assess how efficiently employees meet deadlines and achieve goals. This data allows you to reward those who consistently excel.

Performance Metrics Employ performance metrics such as project completion rates, error rates, or customer satisfaction scores to assess individual performance. These metrics can be critical in making salary decisions based on quantifiable, objective data.

Employ performance metrics such as project completion rates, error rates, or customer satisfaction scores to assess individual performance. These metrics can be critical in making salary decisions based on quantifiable, objective data.

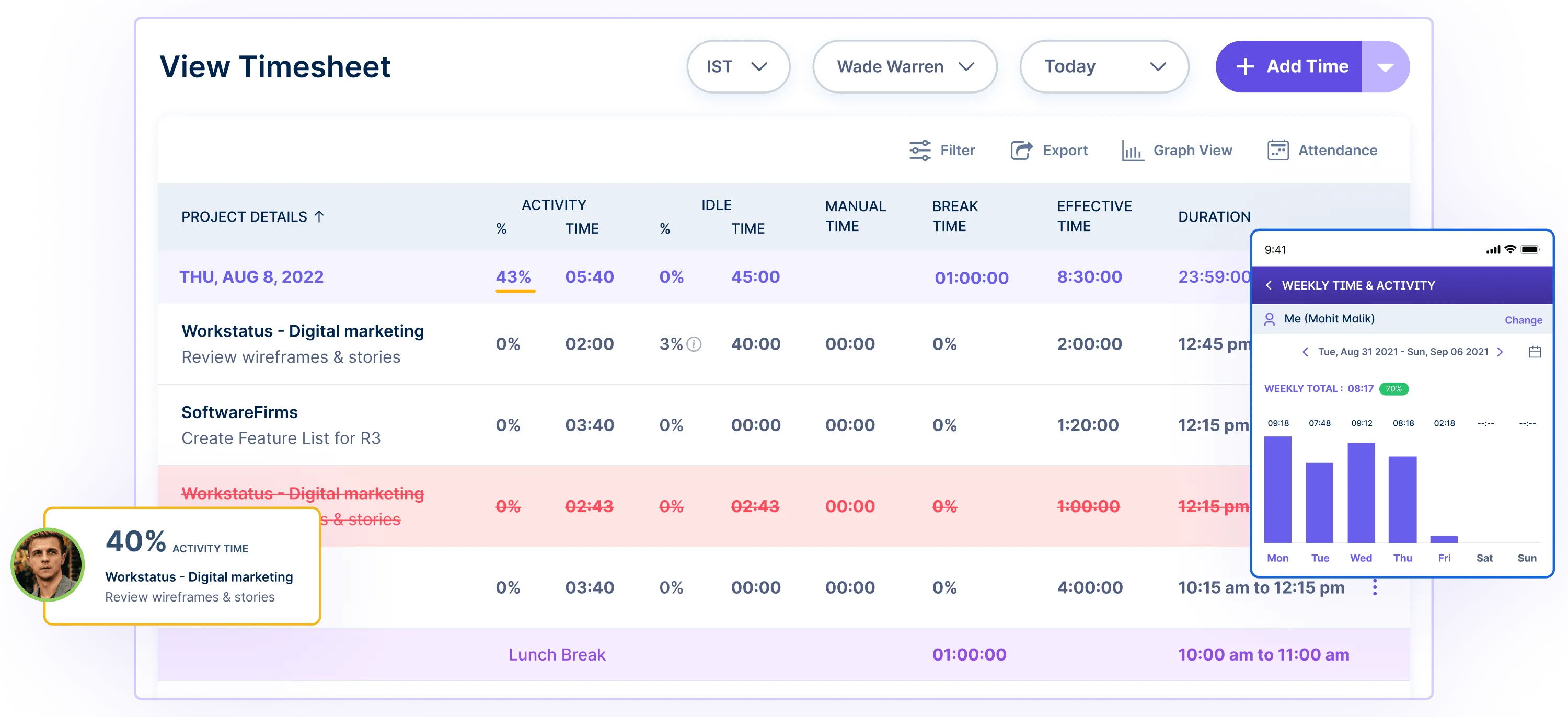

3. Online Timesheets

Online timesheets are a fundamental component in determining salaries in India, especially when using Workstatus features. Here’s a deeper dive into how this feature can be beneficial:

Accurate Record Keeping

Online timesheets provide a centralized digital record of all working hours. This ensures that salary calculations are precise, reducing the risk of errors or disputes.

Overtime Tracking![]()

In India, labor laws often require extra compensation for overtime hours. Online timesheets enable you to monitor and account for these additional hours, ensuring legal compliance and fair compensation.

Flexible Work Arrangements

In a landscape where remote work and flexible hours are becoming more common, online timesheets ensure that all working hours are properly accounted for, contributing to equitable compensation and compliance with labor regulations.

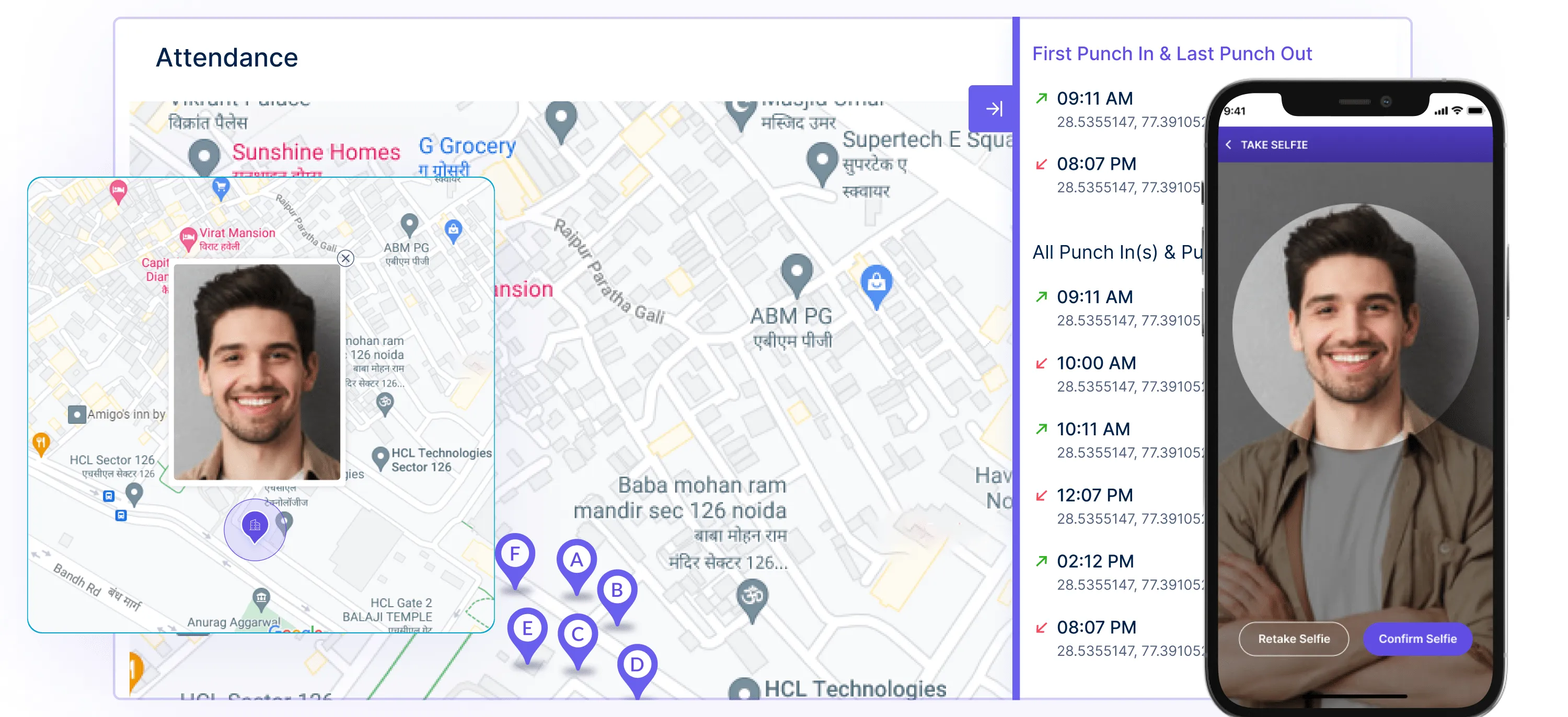

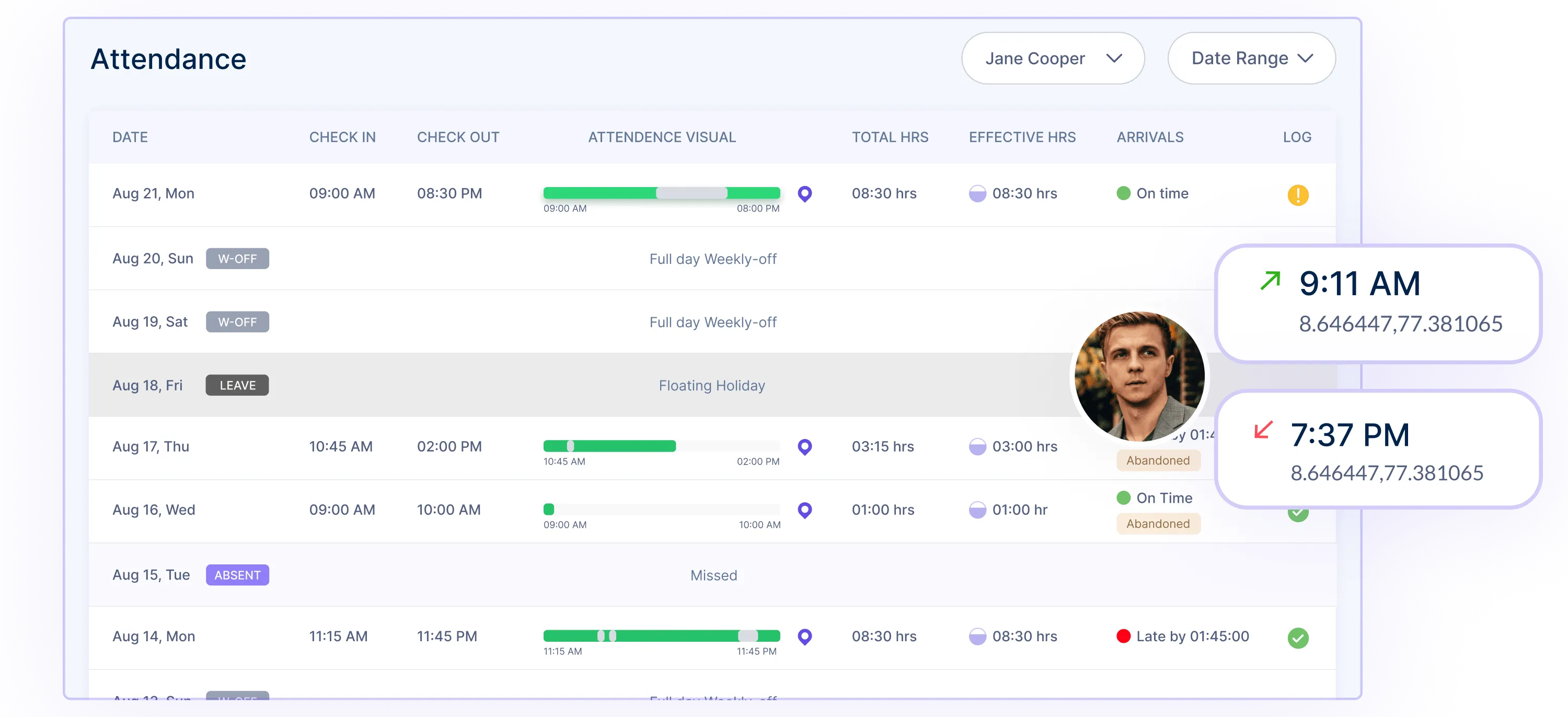

4. Attendance Management With Selfie Validation

Workstatus attendance management feature, coupled with selfie validation, can play a pivotal role in salary determination. Here’s a closer look:

Accurate Attendance Records

Workstatus attendance management system keeps a precise record of when employees clock in and out. This data is essential for tracking attendance and ensuring that salaries are based on actual working hours.

Selfie Validation

Selfie validation adds an extra layer of security and authenticity to attendance tracking.

Employees take a selfie at the start and end of their shifts, helping to prevent buddy punching and ensuring that the aligned employees are present for dedicated shifts.

Improved Accountability

The combination of attendance management and selfie validation holds employees accountable for their working hours.

This transparency helps establish trust and ensures that employees are fairly compensated based on attendance and commitment.

5. GPS Tracking

GPS tracking is a valuable feature that can aid in salary decisions, especially for employees working remotely or in the field:

![]()

Location Verification

GPS tracking verifies the location of employees, confirming whether they are working from designated work areas and adhering to the job requirements.

Travel Time Compensation

For field workers or employees who need to travel, GPS tracking can help calculate travel time and expenses, which can be factored into their salary. This ensures fair compensation for time spent on the road.

Compliance with Worksite Policies

Monitoring GPS data ensures employees comply with worksite policies, such as punctuality and designated work areas. Non-compliance may result in appropriate salary adjustments.

6. Payroll Management

Workstatus’s payroll management feature is central to determining salaries and ensuring timely, accurate payouts:

Automated Salary Calculation

Workstatus payroll management automates calculating employee salaries. It considers various factors, such as hours worked, pay rates, bonuses, deductions, and taxes, resulting in precise salary figures.

Compliance with Regulations

The payroll management system helps ensure compliance with local labor laws and tax regulations. This is critical to avoid legal issues and ensure that salaries are not only fair but also legally sound.

Efficient Record Keeping

Workstatus payroll management feature maintains detailed records of salary transactions, making it easier to review and audit past payments. This can be helpful for internal audits and tax reporting.

Direct Deposit Integration

The system can be integrated with direct deposit services, ensuring that employees receive their salaries in a timely and convenient manner, which is important for maintaining employee satisfaction.

Workstatus provides a comprehensive solution for salary determination, considering attendance, location, financial processes, and payroll management.

This holistic approach enables businesses to make well-informed, fair, and compliant decisions regarding employee compensation.

Tips for Negotiating Salaries in India

Negotiating salaries in India can be a critical step in your career. It’s essential to approach this process with confidence and preparation.

Here are five tips to help you negotiate your salary effectively:

1. Research Salary Benchmarks

- Before entering salary negotiations, research salary benchmarks for your industry, job role, and location. Websites like:

- Glassdoor

- PayScale

Can provide valuable insights into the typical salary ranges for your position.

- Knowing the industry standards will help you set realistic expectations and ensure you’re not undervaluing your skills or asking for an unrealistic figure.

2. Highlight Your Accomplishments

- During the negotiation, emphasize your achievements, skills, and experience. Clearly articulate how your contributions have positively impacted your previous employers or how you can add value to the prospective company.

- Provide specific examples of projects you’ve completed and explain how your expertise can benefit the organization.

3. Consider The Total Compensation Package

- Salary negotiation is not only about the base salary. Factor in other components of the compensation package, such as bonuses, benefits, and perks like health insurance, retirement plans, or stock options.

- Understanding the full compensation package can help you negotiate a more comprehensive and satisfactory deal.

4. Be Open To Negotiation

- It’s essential to maintain a flexible and open attitude during the negotiation process. Listen to the employer’s offer and be willing to discuss different options.

- If the initial offer falls short of your expectations, politely express your desire for a higher package while being respectful and open to compromise.

5. Practice Effective Communication

- Effective communication is key during salary negotiations. Be clear, confident, and respectful in your conversations. Practice your negotiation skills beforehand to ensure you convey your points effectively.

- Avoid making ultimatums or appearing too aggressive. Instead, focus on building a collaborative relationship with your potential employer.

Conclusion

Understanding salaries in India is a multifaceted process that involves various factors, including industry standards, skills, and negotiation strategies.

By considering these elements, individuals and businesses can make informed decisions about compensation that are fair, competitive, and compliant with local regulations.

Workstatus provides valuable tools and features that can assist in this journey, simplifying payroll, tracking productivity, and ensuring accurate salary determinations.

To explore how Workstatus can help you streamline your salary management and enhance your HR processes, take the next step and schedule a demo today.