Table of Contents

Introduction

Ever feel like you’re not completing enough tasks in a day? Are you confused and not moving forward? For financial firms, this lack of productivity could be a serious problem.

Boosting productivity is the key to achieving more quickly and tackling your unique challenges. Without optimal productivity, you may struggle with the following:

- Delays in processing transactions

- Increased operational costs

- Potential compliance issues

So, it’s become important for finance companies to stay efficient if they want to make more money and keep their customers happy.

One powerful solution to improve productivity is implementing employee monitoring tools like Workstatus. These tools let you track employee activity, identify bottlenecks, and optimize workflows for maximum efficiency.

Did You Know?

Studies show that a 20% productivity increase can raise profits by 35%.

This blog post will discuss tools and tips enabling your workforce to achieve more every day with minimum time and effort.

Let’s dive.

Need for Employee Monitoring Software For Finance Companies

Finance companies encounter unique challenges when they lack employee monitoring and tracking software.

Here are the key challenges faced by finance companies without such software:

1. Inefficient Time Tracking

Without monitoring and tracking software, finance companies struggle to measure and optimize employee work hours accurately.

Inaccurate timekeeping can lead to the following:

- Billing discrepancies

- Inefficient resource allocation

- Low productivity

This is particularly problematic in finance, where time-sensitive tasks, such as trading, reporting, and compliance, require meticulous time management.

Insight

Inaccurate time tracking practices lead to delays in financial reporting for 60% of finance companies.

2. Lack of Oversight and Accountability

Finance companies heavily rely on individual and team performance to deliver the following:

- Accurate financial analysis

- Risk management services

- Client Services

Without monitoring and tracking software, it becomes difficult to establish and maintain accountability among employees.

Also, managers have very limited visibility into key areas such as:

- Individual workloads

- Task progress

- Performance metrics

This lack of oversight makes it hard to identify underperforming employees, address productivity issues promptly, and ensure consistent quality standards.

3. Data Security and Compliance Risks

Finance companies handle sensitive financial information, making data security and compliance paramount.

Without monitoring and tracking software, companies face increased risks, such as:

- Unauthorized data access

- Data breaches

- Compliance violations

Inadequate control over data handling practices and limited visibility into employee activities make it difficult to enforce security protocols, detect potential threats, and ensure adherence to regulatory requirements, such as GDPR, PCI-DSS, or SOX.

4. Ineffective Task Prioritization and Resource Allocation

Finance companies deal with numerous complex projects and tasks that require precise prioritization and efficient resource allocation.

Without monitoring and tracking software, managers struggle to carry out the activities such as:

- Assess task urgency

- Allocate resources effectively

- Balance workloads

It can result in missed deadlines, inefficiencies in project management, and decreased overall productivity.

5. Collaboration and Communication Challenges

Collaborative efforts and effective communication are vital in finance companies, where teams work on interconnected tasks.

It becomes challenging to track and coordinate collaborative activities, leading to miscommunication, delays, and errors in financial processes, such as:

- Reconciliations

- Approvals

- Audits

It can impede decision-making, hinder teamwork, and negatively impact client satisfaction.

6. Inaccurate Project Tracking and Reporting

Monitoring and tracking software provides finance companies with real-time insights into:

- Project progress

- Task completion rates

- Productivity

Without monitoring tools like Workstatus, companies struggle to do the following tasks:

- Accurately track project milestones

- Evaluate task dependencies

- Generate comprehensive reports

It can result in inaccurate financial reporting, compromised transparency, and difficulty assessing project profitability.

Insight

70% of finance companies experience cost overruns due to inaccurate project tracking and reporting.

Time To Overcome Challenges with Workstatus!

Success in finance heavily depends on productivity and every second counts. That’s where Workstatus comes into play – a powerful tool designed to assist finance teams in maximizing efficiency and overcoming common hurdles.

Here’s how Workstatus can revolutionize your operations:

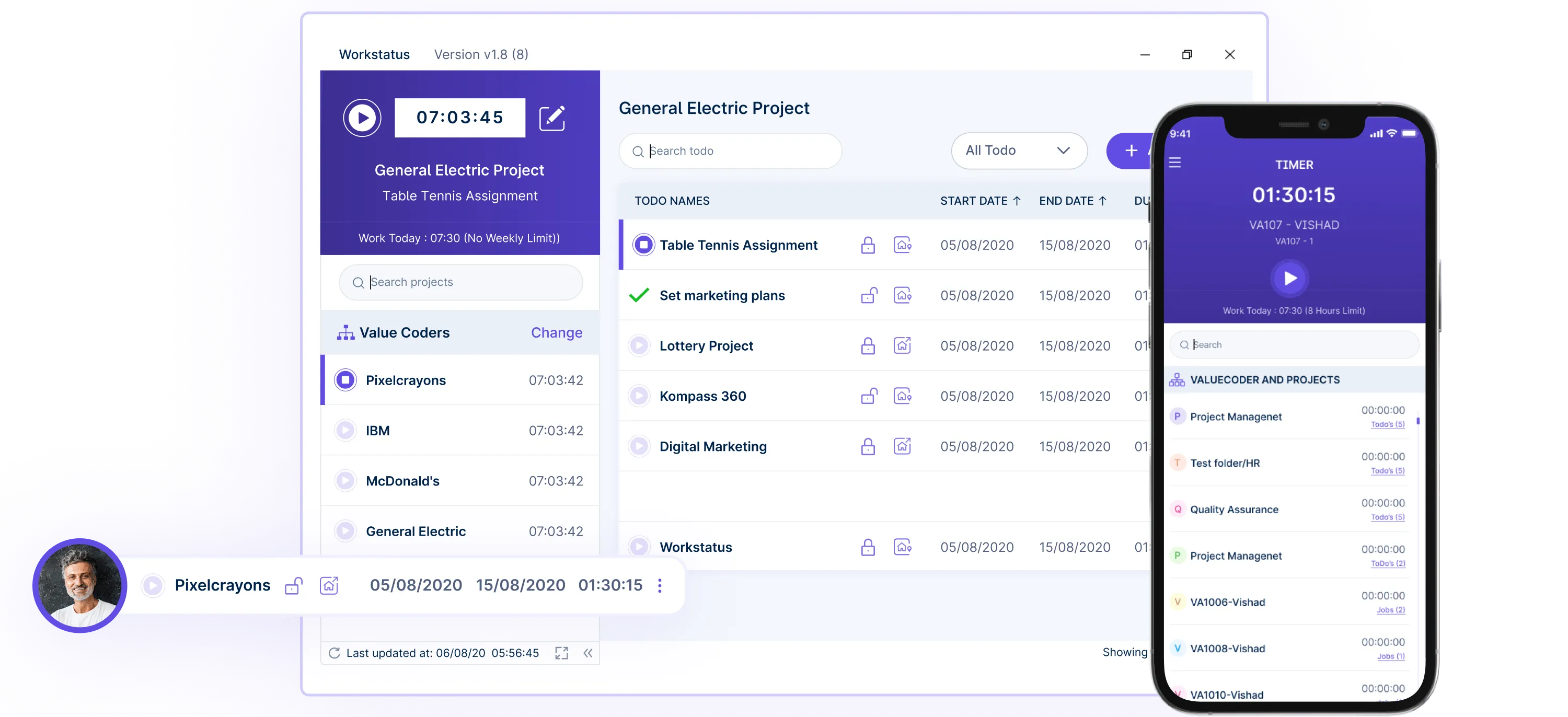

1. Time Tracking

Get real-time insights into how your team spends their time. With accurate time tracking, you can:

- Bill clients precisely for services rendered, ensuring fair compensation

- Analyze project profitability and costs for smarter resource allocation

- Assign the right people to the right tasks, maximizing staff utilizatio

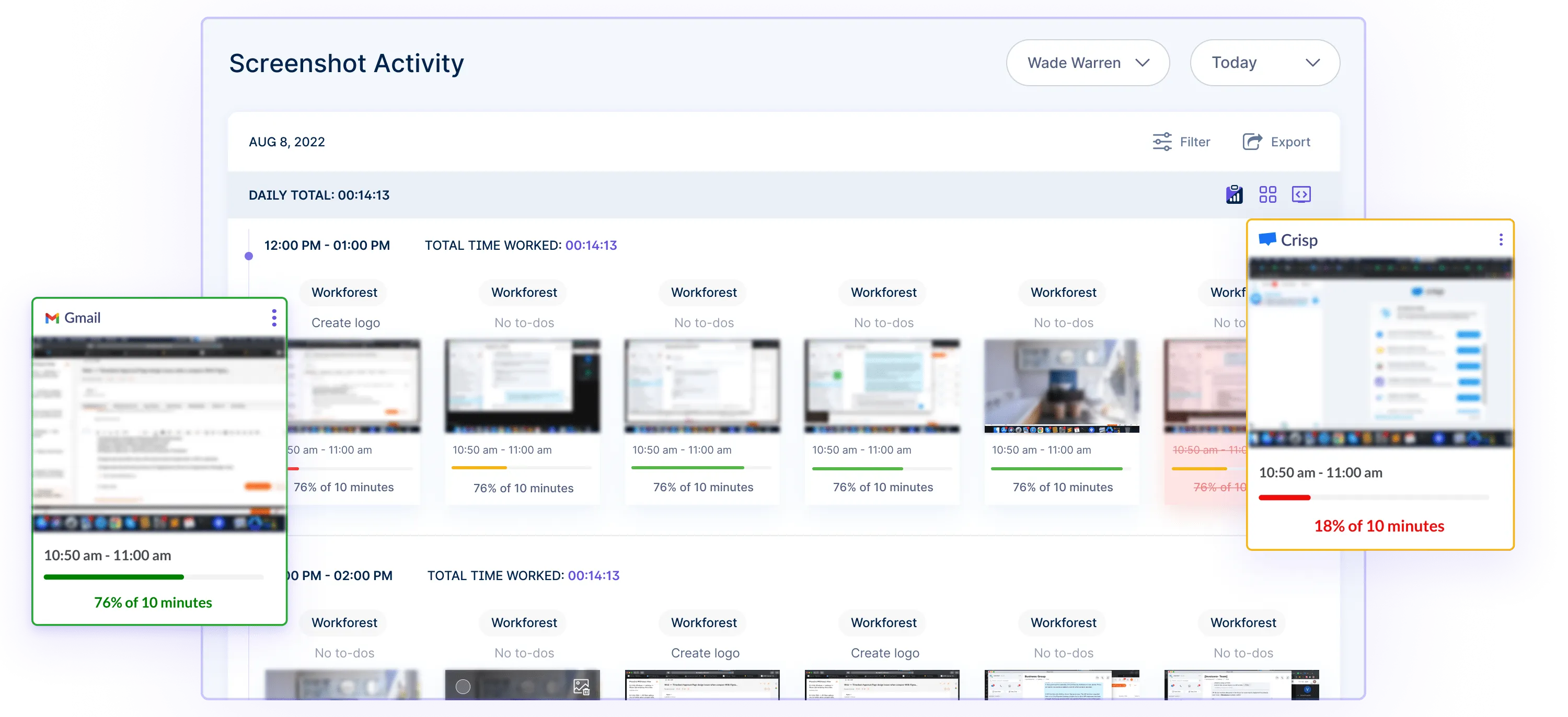

2. Active Screenshots

Capturing screenshots may seem minor, but it can have a major impact:

- Verify client service delivery and address disputes transparently

- Detect unauthorized access or fraudulent activities, mitigating risks

- Document compliance with internal and regulatory requirements

3. Productivity Analytics

3. Productivity Analytics

Knowledge is power, and Workstatus empowers you with data-driven insights:

-

- Objectively evaluate individual and team performance

- Pinpoint efficiency gaps and implement targeted strategies

- Foster a culture of excellence through transparent productivity metrics

![]()

4. Internet and Application Usage Tracking

In finance, distractions can be costly. Workstatus helps you:

- Enforce policies to keep your team focused on work-related tasks

- Identify potential security risks like unauthorized software or dubious websites

- Comply with data protection regulations by monitoring and blocking non-compliant access

![]()

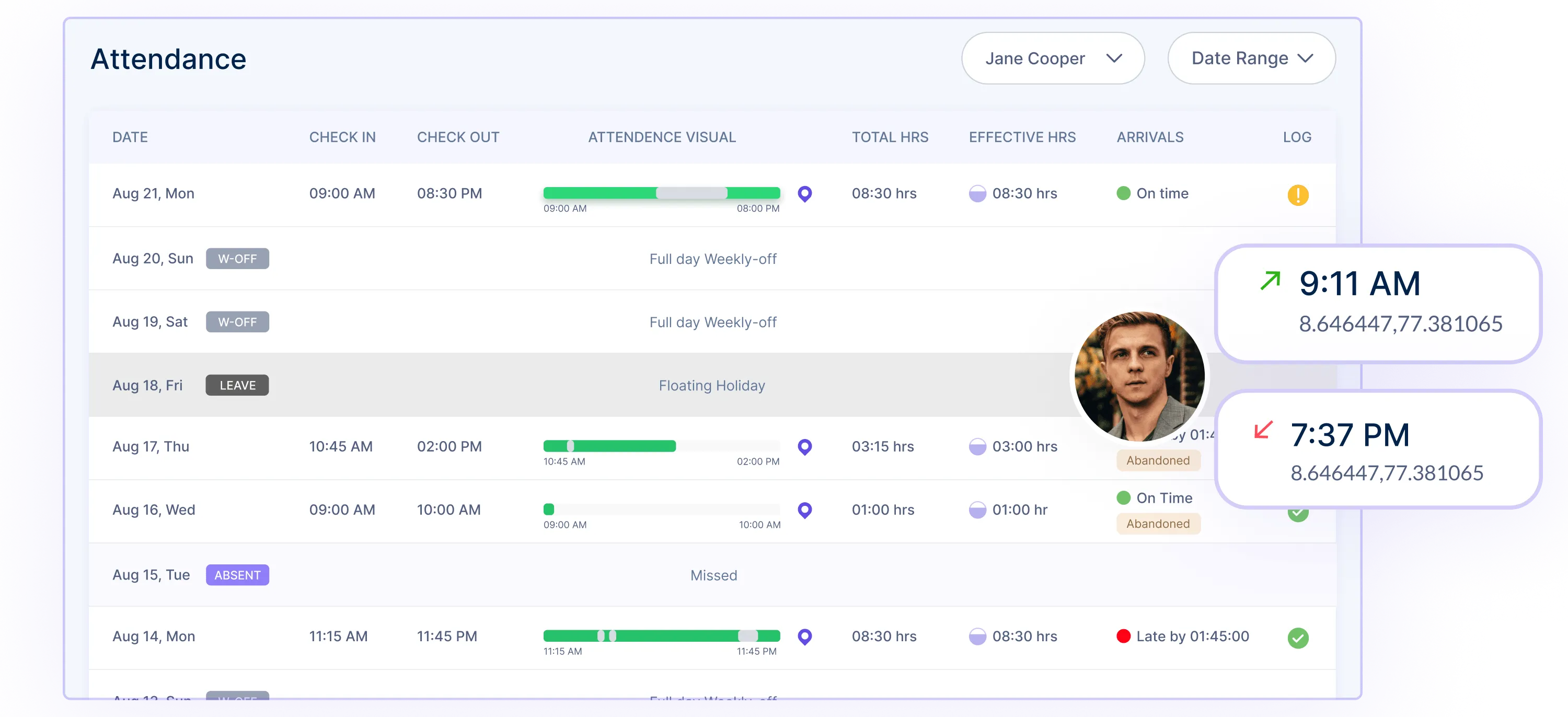

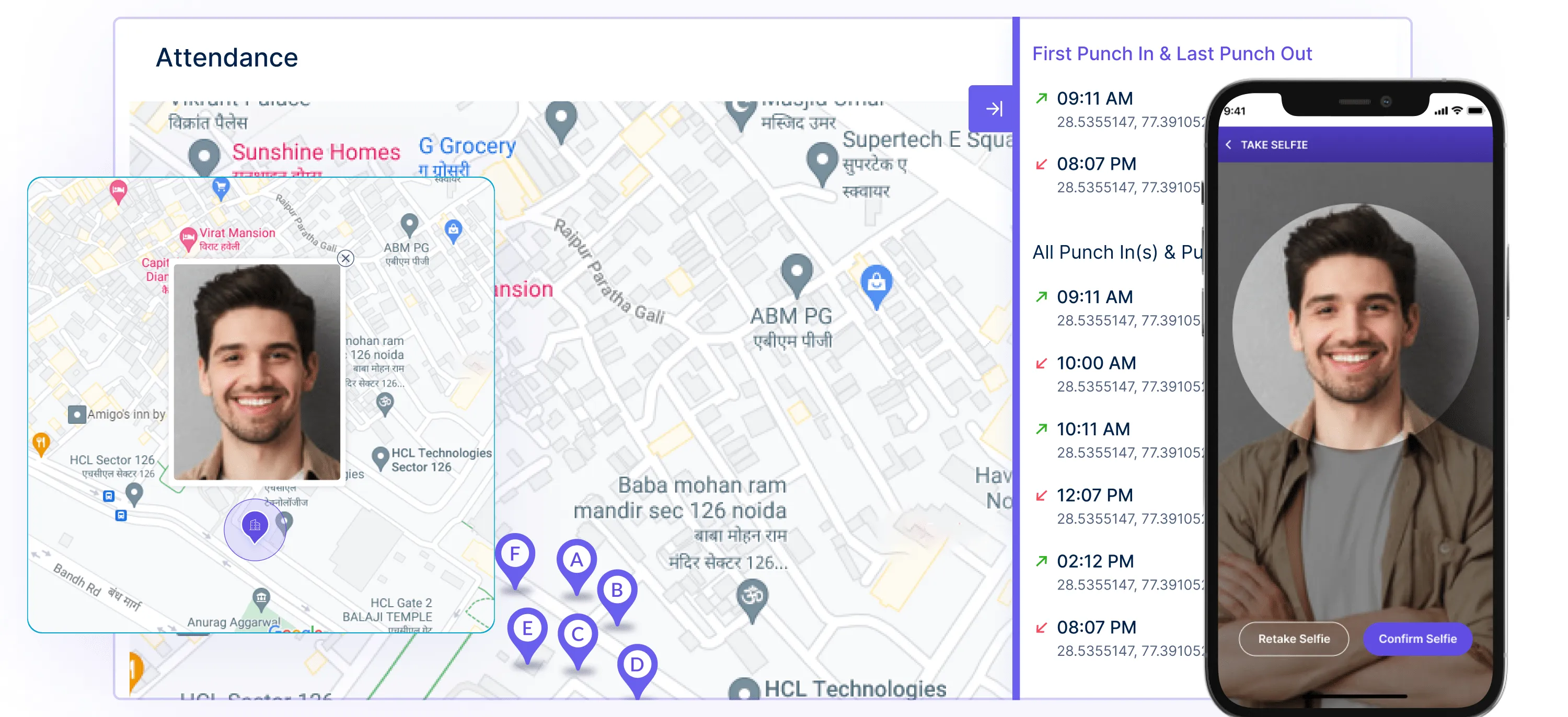

5. Attendance and Absence Tracking

Effective resource management is key. With Workstatus, you can:

- Streamline leave management processes for accurate record-keeping

- Plan and allocate resources effectively for critical operations

- Verify attendance with selfie check-ins, preventing buddy punching

-

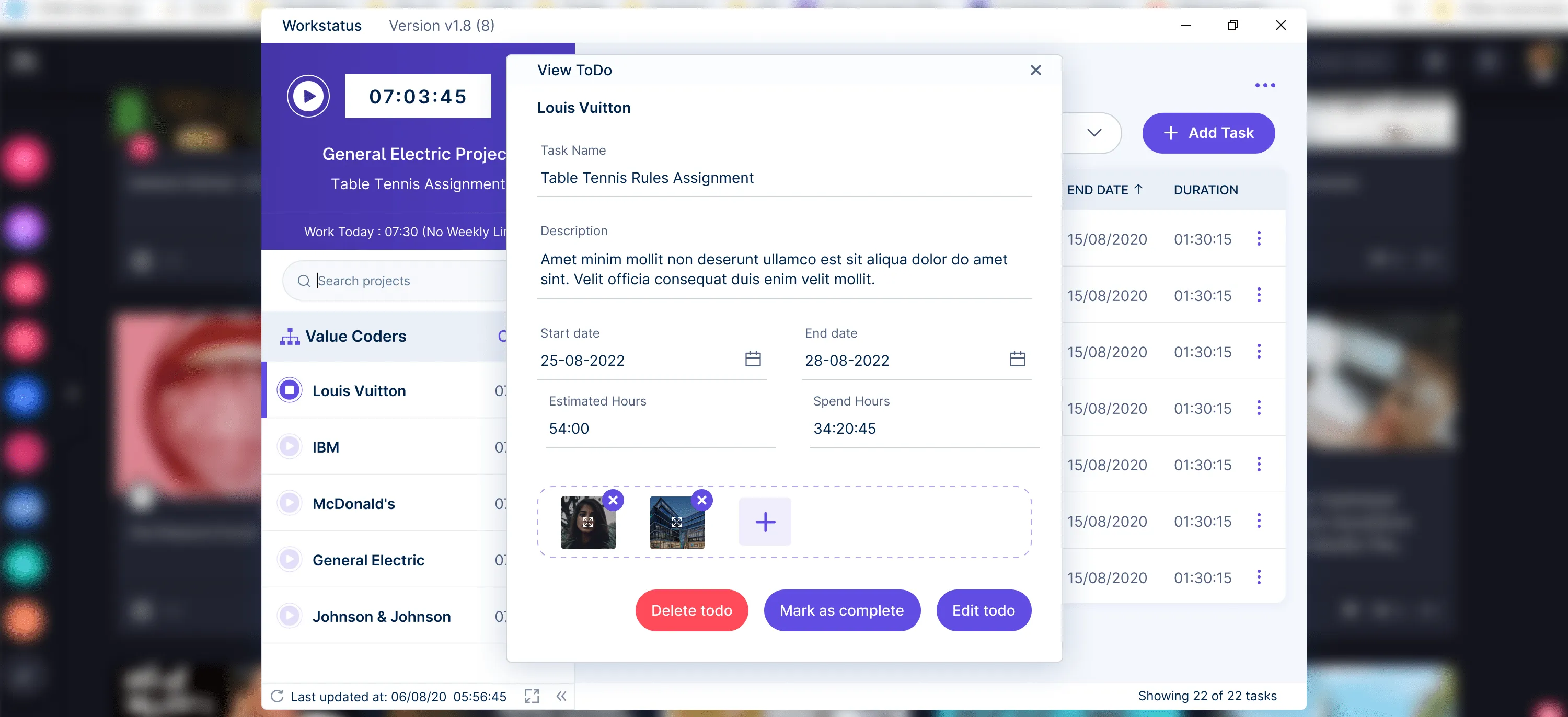

Project and Task Management

Juggling multiple projects can be challenging. Workstatus helps you:

- Manage project deadlines and milestones for timely delivery

- Assign the right employees based on expertise and availability

- Streamline workflows by tracking progress and identifying bottlenecks

7. Integration

Workstatus seamlessly integrates with other tools like Zoho and Trello, enabling:

- Seamless data flow between platforms, eliminating manual entry

- Better efficiency by accessing data from multiple sources

- Customization and scalability to adapt to your specific needs

8. Mobile Apps

Work happens everywhere. With mobile apps for Windows, Android, Linux, and iOS, you can:

- Support flexible work arrangements with on-the-go tracking

- Boost productivity by providing mobile access to features

- Ensure accessibility for your finance team anytime, anywhere

Case Studies: Success Stories of Workstatus Implementation in Finance Companies

Read the infographics to know Workstatus has helped different financial companies with employee monitoring and tracking.

These success stories illustrate how finance companies achieved tangible benefits by implementing Workstatus, including:

- Improved productivity

- Enhanced compliance

- Streamlined operations

- Increased client satisfaction

Making the Most of Workstatus – Top Tips

Workstatus is an amazing tool to supercharge your finance team’s productivity. But like any tool, it works best when used properly.

Here are some insider tips to get the most out of Workstatus:

1. Start With Training

Don’t just throw Workstatus at your employees and expect magic.

Take the time to properly train everyone on how to use all the features.

Consider having product experts come on-site or do webinars to make sure everyone is 100% comfortable.

2. Get Buy-In

New software can sometimes face resistance, especially for tracking capabilities. But Workstatus isn’t about micromanaging – it’s about supporting your team.

Explain the bigger goals of efficiency, work-life balance, fair compensation, etc. Get people excited!

3. Customize Settings

Workstatus has many settings to fit your company’s specific needs and policies.

Don’t just use the defaults. Analyze how your teams work, what tracking level is needed, and which websites/apps to allow or block.

Tailoring it makes all the difference.

4. Use Data Thoughtfully

The analytics in Workstatus provide incredibly valuable data insights. But don’t go overboard scrutinizing everything.

Look at trends, identify coaching opportunities, and facilitate open dialogues with your team.

5. Celebrate Wins

Is a team knocking it out of the park when hitting deadlines? Is someone consistently going above and beyond?

Use the data to recognize and reward those stellar efforts! Positive reinforcement keeps morale high.

6. Continual Improvement

Implementing new software is never a one-and-done. Listen to employee feedback, watch for workflow bottlenecks, and keep refining how you use Workstatus.

A commitment to continual improvement is key.

Closing Thoughts

Employee monitoring and tracking software in finance companies is a game-changer for improving productivity.

By providing transparency, optimizing time management, ensuring compliance, and facilitating remote work, it empowers finance professionals to work efficiently to achieve better outcomes.

Employee monitoring and tracking tools like Workstatus is a powerful tools that can revolutionize productivity in finance companies and drive success in the dynamic world of finance.

Unlock Your Finance Company’s Full Potential.

Supercharge your productivity, optimize operations, and drive success with Workstatus.

FAQs

Ques. Will employee monitoring and tracking software invade employee privacy?

Ans. No, employee monitoring and tracking software can be implemented in a way that respects privacy rights.

It focuses on tracking work-related activities to optimize productivity while personal activities remain private.

Ques. How can employee monitoring and tracking software enhance time management in finance companies?

Ans. By accurately tracking and recording employee work hours and activities, the software enables finance companies to identify time-wasting tasks, optimize resource allocation, and improve overall time managemeImproved productivitynt for increased productivity.

Ques. Will implementing employee monitoring and tracking software affect employee morale and job satisfaction?

Ans. When implemented transparently and with clear communication, employee monitoring and tracking software like Workstatus can enhance accountability, fairness, and productivity.

Ultimately contributing to employee satisfaction by aligning goals, providing data-driven feedback, and facilitating professional growth.