Table of Contents

For many accounting firms, keeping track of billable hours automatically can feel like a daily struggle.

Manually entering time, checking reports, and fixing small mistakes often eats up hours that could be spent serving clients.

Without automation, accountants face common problems like:

- Missed or forgotten billable hours

- Wrong or incomplete time logs

- Slow billing and delayed payments

- Too much manual data entry

- Confusing approvals and unclear client billing

All these small issues add up, causing lost revenue, stress, and wasted time. But it doesn’t have to be this way.

With the right tools, accounting firms can track every billable minute, improve accuracy, and get paid faster, without extra effort.

In this blog, we’ll explore 8 simple ways accounting firms can automate billable hours using accounting firm automation to make time tracking easier and more accurate.

The Growing Need for Automation in Accounting Firms

Let’s be real: accounting work takes a lot of time.

There are so many tasks, reports, and numbers to manage every day. Doing everything by hand makes it easy to miss hours, make mistakes, or send bills late.

That’s where automation helps and streamline accounting processes. It saves time, keeps work accurate, and makes life easier for everyone.

Here’s why more accounting firms are turning to automation:

Saves time

- No more typing the same data again and again.

Fewer mistakes

- Every hour and task gets recorded right.

Faster billing

- Invoices go out on time, and payments come in quicker.

Clear reports

- You can see where time and money are going.

Less stress

- Teams work smoothly and finish tasks faster.

Happy clients

- Clear billing builds trust and keeps clients satisfied.

In short, automation helps accounting firms do more with less effort. It’s like having an extra helping hand that never makes mistakes or forgets a task.

Way 1: Automated Time Tracking Across Devices

![]()

Let’s face it; tracking time is one of those things that sounds easy… until you actually do it.

You forget to start the timer, you switch between devices, or you write down hours later and hope they’re right.

Sound familiar? You’re not alone.

Challenges:

- It’s easy to forget to start or stop timers.

- Hours get written down late or missed completely.

- Everyone uses different tools, and the data doesn’t match.

- Manual entries often cause billing mistakes.

- Managers have no clear view of who’s working on what.

Now imagine if all that could happen automatically. That’s what automated time tracking does.

How Automated Time Tracking Across Devices Helps:

- Tracks time the moment you start working; no reminders needed.

- Works smoothly on laptop, desktop, or phone.

- Brings all-time logs together in one place.

- Shows what tasks people are working on in real time.

- Makes billing faster and more accurate.

If you want to make time tracking this easy, try tools like Workstatus; here’s how it helps:

How Workstatus Helps:

- Tracks time automatically across desktop, web, and mobile.

- Captures activity levels and tasks in real time.

- Syncs data across all devices; no manual updates.

- Prepares ready-to-use timesheets for billing.

- Helps teams stay focused on work, not on timers.

With Workstatus, time tracking becomes effortless; you just work, and it handles the rest.

Way 2: Generate Invoices from Timesheets in One Click

We’ve all been there; hours tracked, tasks done…but then comes the hard part: making invoices.

Copying time from spreadsheets, checking totals, and matching projects can take hours. And one small mistake? It can mess up the whole bill.

That’s why automating this step is such a time-saver.

Challenges:

- Creating invoices by hand takes too long.

- Missed or wrong time entries lead to billing errors.

- Switching between tools slows everything down.

- Clients get invoices late, which delays payments.

- Tracking which invoices are sent or paid gets messy.

How Automating Invoice Generation Helps:

- Turns approved timesheets into invoices instantly

- Pulls correct hours, rates, and project details automatically

- Reduces errors from manual entry

- Speeds up billing and improves cash flow

- Gives clients clear, accurate bills on time

If you want to skip the manual work, tools like Workstatus can make invoice creation and billing automation for accounting firms simple and fast.

How Workstatus Helps:

- Creates invoices directly from tracked time and projects.

- Auto-fills client details, rates, and totals correctly.

- Lets you review and send invoices in one click.

- Keeps all invoices in one dashboard for easy tracking.

- Helps you get paid faster with zero billing stress.

With Workstatus, a time tracking software for accountants, invoicing becomes effortless; no spreadsheets, no mistakes, just one click and done.

Way 3: Set Custom Billing Rates by Project/Team Member

Not every project or client is the same, and neither are your team’s billing rates.

But when you track time manually, keeping all those rates straight can get confusing fast. One wrong rate can throw off your whole invoice.

Challenges:

- Hard to manage different rates for each client or project.

- Mistakes in rate entry lead to wrong invoices.

- Time wasted checking and rechecking rate sheets.

- Difficult to track who worked on what task at what rate.

- Hard to adjust rates quickly for new projects.

How Custom Billing Helps:

- Lets you set specific rates for each project or team member.

- Calculates totals automatically; no need to double-check.

- Keeps all rate data stored safely in one place.

- Makes billing faster, clearer, and mistake-free.

- Helps ensure clients are charged the right amount every time.

If you want an easy way to handle custom billing, tools like Workstatus make it simple.

How Workstatus Helps:

- Lets you set hourly rates for each project or team member.

- Applies correct rates automatically when time is tracked.

- Updates totals in real time; no manual edits needed.

- Keeps invoices 100% accurate for every client.

- Saves time and avoids billing confusion.

With Workstatus, your billing always matches your work; fair, simple, and accurate.

Way 4: Integrate with Existing Accounting Software

Switching between tools can be tiring; one for time tracking, one for billing, and another for accounting.

When data doesn’t sync, mistakes happen. And fixing them takes even more time.

That’s why integration is so important. When your time tracking and accounting tools talk to each other, everything just works smoothly.

Challenges:

- Data needs to be entered in many places.

- Mismatch between time logs and invoices.

- Hard to keep client and project details updated.

- Delays in reports because systems don’t sync.

- Extra time spent fixing small errors.

How Integration Helps:

- Connects your time tracking tool with your accounting software.

- Moves data automatically; no need to re-enter it.

- Keeps invoices, payments, and client info updated in one place.

- Saves time and reduces human mistakes.

- Makes reports and billing fast and accurate.

Way 5: Track Billable vs. Non-Billable Hours Clearly

Do you ever wonder where your team’s time really goes?

Some hours bring in money (billable), while others don’t (non-billable); but when everything is tracked the same way, it’s hard to tell the difference.

That’s where automation helps. It gives a clear view of how time is spent, so you know what’s earning and what’s not.

Challenges:

- Hard to separate billable and non-billable work.

- Missed tracking leads to wrong client billing.

- No clear view of how much time goes into admin work.

- Teams spend hours fixing reports manually.

- Difficult to know which projects bring profit.

How Tracking Billable vs. Non-Billable Hours Helps:

- Shows exactly where time is being spent.

- Helps identify unproductive or unpaid work.

- Keeps billing transparent for clients.

- Makes reports and budgeting more accurate.

- Improves how teams plan future projects.

If you want an easier way to track both types of hours, Workstatus makes it simple and clear.

How Workstatus Helps:

- Separates billable and non-billable hours automatically.

- Tracks time by project, task, or client.

- Creates clear reports for billing and performance.

- Helps managers see which projects are most profitable.

- Ensures every billable hour is captured and invoiced.

With Workstatus, you can automate timesheets, so that you always know where your team’s time goes, and that means better planning, better billing, and better profits.

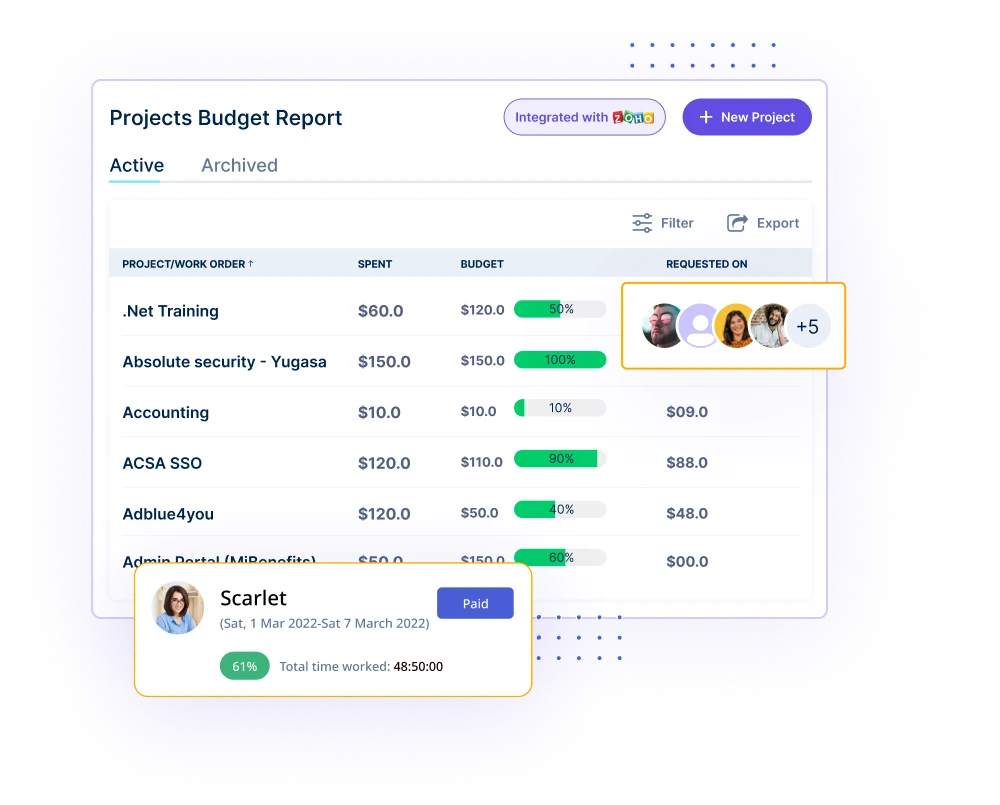

Way 6: Automate Payroll based on Approved Timesheets

Payroll is one of those tasks that must be right every single time. But when it’s done manually, mistakes can easily sneak in, and fixing them takes forever.

Automation makes payroll simple, quick, and accurate.

Challenges:

- Manually entering hours takes too long.

- Small mistakes cause wrong payments.

- Hard to check which hours are approved or not.

- No clear record of time and pay data.

- Payroll delays frustrate teams.

How Automated Payroll Helps:

- Uses approved timesheets to calculate pay automatically.

- Removes errors from manual data entry.

- Make sure everyone is paid correctly and on time.

- Keeps full records of hours and payments.

- Saves time for both HR and managers.

If you want to make payroll easy and accurate, Workstatus can help

How Workstatus Helps:

- Links payroll directly to approved timesheets.

- Calculates pay automatically based on tracked hours.

- Keeps payment data ready for quick review.

- Reduces mistakes and late payments.

- Makes payroll simple and stress-free.

With Workstatus, payroll finally feels effortless; clean payouts, zero delays, and complete accuracy, backed by a modern time and billing platform

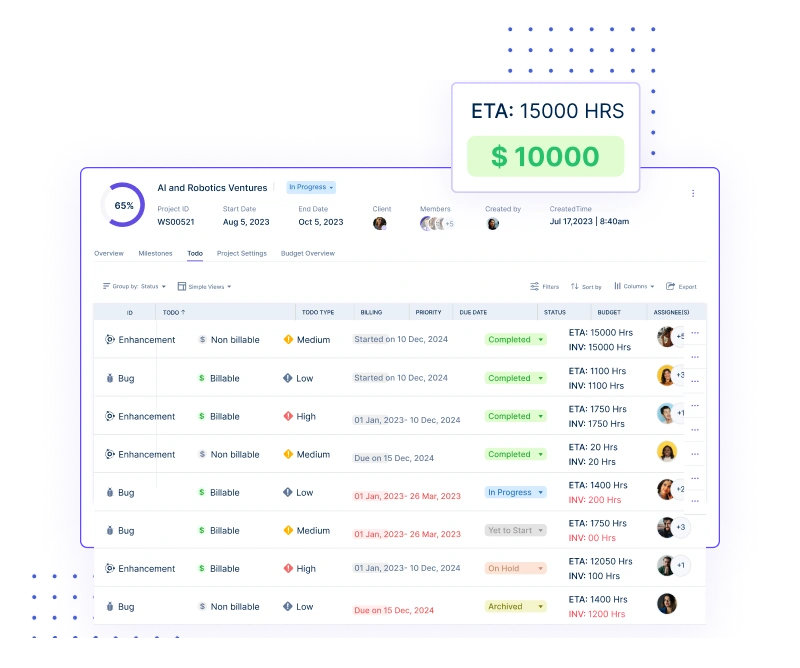

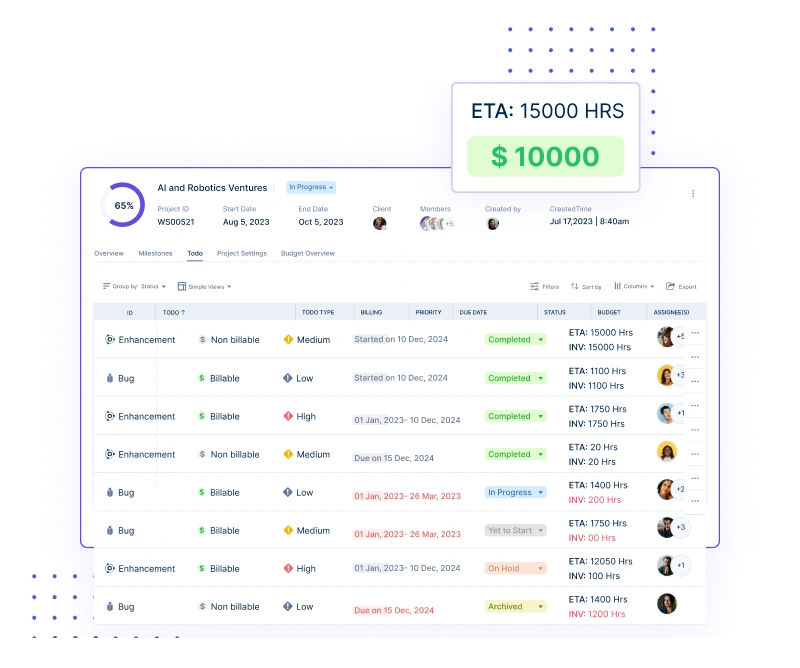

Way 7: Monitor Project Budgets with Automated Alerts

Keeping projects under budget is never easy; costs change, hours add up, and before you know it, the budget is gone.

Automation helps you stay on top of numbers before things go off track.

Challenges:

- Hard to track spending and hours in real time.

- Budgets go over before anyone notices.

- Managers lack alerts for rising costs.

- No quick view of which projects are at risk.

- Manual checks take too long and aren’t always correct.

How Automated Budget Alerts Help:

- Tracks time, cost, and progress in one place.

- Sends alerts when budgets are close to the limit.

- Helps catch problems before they grow.

- Keeps projects on time and within budget.

- Builds trust with clients through transparent tracking.

Want to stay in control of every project? Workstatus makes it easy.

How Workstatus Helps:

- Tracks project hours and costs in real time.

- Sends automatic alerts when budgets hit set limits.

- Gives clear budget reports for quick decisions.

- Helps teams manage multiple projects smoothly.

- Keeps everything transparent for clients and managers.

With Workstatus, no project ever goes over budget without you knowing first.

Way 8: Access Detailed, Customizable Reports

Reports are where you see the full story: how time is spent, how projects are doing, and where profits come from. But when reports are manual, it’s easy to miss key details.

Automation brings everything together in clear, ready-to-use reports.

Challenges:

- Reports take too long to prepare manually.

- Data often comes from different tools and doesn’t match.

- Hard to find clear insights from scattered data.

- Managers spend hours reviewing spreadsheets.

- No easy way to track trends or performance.

How Automated Reports Help:

- Combine all data in one place automatically.

- Give clear insights in just a few clicks.

- Help teams make better, faster decisions.

- Save hours of manual report work.

- Show real-time performance anytime.

If you want reports that actually work for you, Workstatus can help.

How Workstatus Helps:

- Creates detailed reports on time, tasks, and projects.

- Lets you customize reports by client, project, or team.

- Updates data automatically; always real-time.

- Helps managers see where time and money are going.

- Turns complex data into simple, clear insights.

With Workstatus, reporting isn’t extra work; it’s your easiest way to stay in control.

Why Workstatus Is the Right Fit for Accounting Firms

Workstatus makes life easier for accounting teams by bringing everything, time tracking, billing, and reporting, into one place.

No more juggling spreadsheets or chasing timesheets.

Here’s why it fits so well:

- Tracks every billable minute automatically.

- Creates invoices straight from timesheets.

- Sends real-time budget alerts.

- Works across devices for remote or hybrid teams.

- Integrates smoothly with your accounting tools.

It’s simple, smart, and saves hours every week; so your team can focus on clients, not admin work. In this digitally transforming financial ecosystem, efficiency is key. Just as accounting firms are streamlining internal operations, major financial institutions are also modernizing their core offerings by adopting new technologies, such as white-label stablecoin payment solutions for banks to deliver faster, borderless payment services.

Conclusion

Automation isn’t just for big firms; it helps every accounting team save time and work smarter.

When your hours, invoices, and reports run automatically, everything stays clear and quick.

It helps you:

- Save time

- Avoid mistakes

- Get paid faster

With Workstatus, all this happens easily, from tracking time to sending invoices. Less stress, faster payments, and a smoother workflow for your firm.

FAQs

Ques: Why should accounting firms use automation?

Ans: Automation saves time, reduces mistakes, and makes billing faster. It helps accountants focus more on clients instead of doing manual work.

Ques: How does automation help track billable hours?

Ans: It records work time automatically, so no hours are missed or forgotten. This keeps billing accurate and fair for every client.

Ques: Can small accounting firms afford automation tools?

Ans: Yes, many tools like Workstatus are made for small and mid-size firms. They’re easy to use and budget-friendly.

Ques: How does Workstatus help accounting firms?

Ans: Workstatus tracks time, creates invoices, and sends reports automatically. It keeps all data in one place and makes daily work simple.

Ques: Is it hard to start using automation?

Ans: Not at all. Most tools are easy to set up. You just sign up, add your team, and start tracking time; everything else runs on its own.