Table of Contents

Are you witnessing your team’s declining motivation? Could this be due to a delayed payout or something else?

In most instances, the obvious reason is the driving factor.

Errors or delays in payroll affect your employees more than you can anticipate.

Manual payroll calculation makes you prone to frequent errors. It can cause financial mistakes that can add to your problems with non-compliance issues and penalties.

Moreover, such errors reflect compromised work ethics that could affect:-

- Employee behaviour

- Talent acquisition

- Employee retention

To avoid these unintended outcomes, it is essential to calculate payroll accurately.

Common Payroll Calculation Challenges

Calculating payroll is a time and resource-intensive process. The following are some of the issues faced with calculating payroll:

Tracking time for Remote or Field Employees

Traditional methods like punch cards or manual timesheets are not feasible for recording the working hours of employees not present in a central office.

It causes allocated individuals to do speculative work.

Managing Different Pay Rates or Overtime Rules

Pay rates for employees vary based on their role, experience, location, or individual contributions.

Moreover, overtime rules are variable with respect to local labor laws, employment contracts, company policies, and myriad other factors.

These intricate tasks require additional input from concerned individuals, compelling them to extend standard working hours.

Handling Paid Time Off and Sick Leave

Employees receive leave and additional time off as part of work policies.

To calculate payrolls, it is essential to make the necessary additions and deductions based on employees’ monthly performance and leave balances.

The complexity of the task often causes HRs and accountants to make unintended mistakes.

Staying Compliant With Changing Tax Laws

Remaining updated with changing tax and labor laws is overwhelming.

Payroll professionals need to remain in touch with the changing regulations to ensure accurate tax calculations, deductions, and timely remittances.

An iota of negligence causes penalties and legal issues.

Calculating Payroll for Multiple Locations

Standard rates vary with distinct geographical locations, necessitating payroll professionals to study different minimum wage laws, tax laws, and reporting requirements.

The overbearing burden of multiple cases seems humanly impossible.

So, how do you calculate payroll without making errors? Are there some measures you may take?

Step-by-Step Payroll Calculation Process

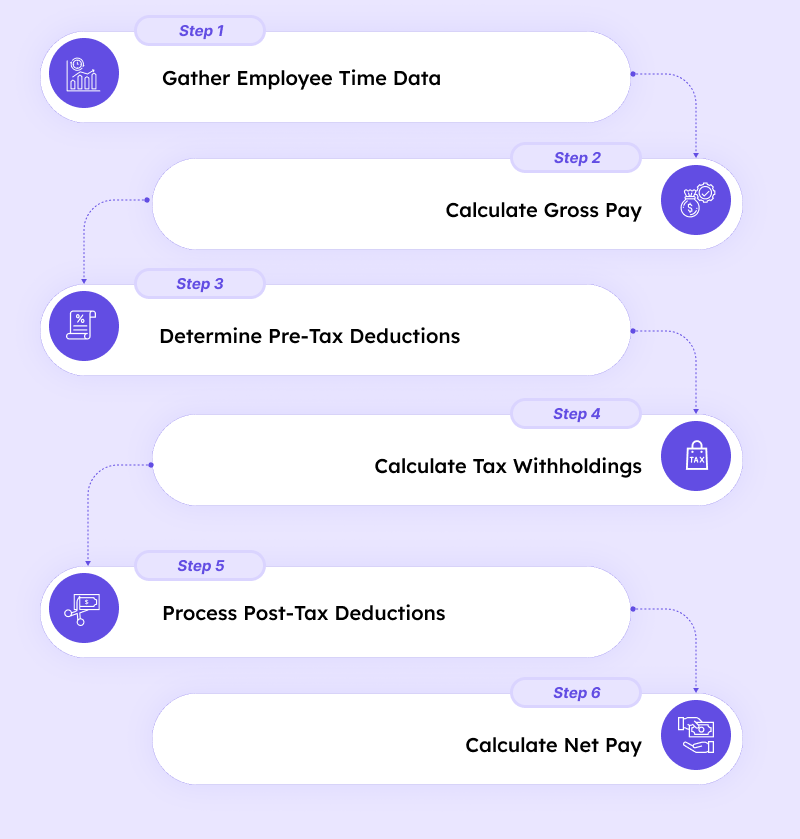

The following are the steps involved in the payroll calculation process:-

Step 1: Gather Employee Time Data

- It begins with gathering the employee data during the specified billable duration.

- Payroll professionals need to initiate the process by determining the total billable hours.

- Furthermore, they need to consider pre-specified pay rates and overtime done by employees, based on the company policy.

- Lastly, they need to separate employees with different terms and conditions of employment.

Step 2: Calculate Gross Pay

- It is calculated by multiplying the pre-specified standard rate by time.

- Calculation is different for salaried employees and individuals working on hourly wages.

- Overtime calculation is further done based on prespecified rates and company policies.

- Finally, the calculation involves the summation of additional remuneration levied by companies.

Step 3: Determine Pre-Tax Deductions

- If the company offers health insurance, the premium is deducted from CTC.

- Further, deductions are involved for 401(k) plans and severance packages.

- Individually, employees can choose voluntary deductions. They are subtracted to offer an accurate payout.

Step 4: Calculate Tax Withholdings

Taxes are deducted before offering net pay to employees. It encompasses evaluating the following taxes:-

- Federal income tax

- State and local income taxes

- Social security and medicare (FICA)

Step 5: Process Post-Tax Deductions

- In case of legal intervention or employee consent, you are required to withhold a specific amount from the salary of employees.

- In the case of voluntary insurance, you may make the needed deductions.

Step 6: Calculate Net Pay

- Net pay is the deduction of gross pay from all the deductions, like pre-tax (income tax, PF), and post-tax (wage garnishments, insurance premiums, and more).

- It is undoubtedly crucial to recheck with billable hours, pay rates, deductions, and several other factors that affect the overall payout.

- Accurate record keeping is the last but most crucial step of the entire process.

These steps, though, may seem simple, but become overbearing when done at scale. You can take these steps with payroll software for maximum efficiency and operational excellence.

How Workstatus Streamlines Payroll Calculations?

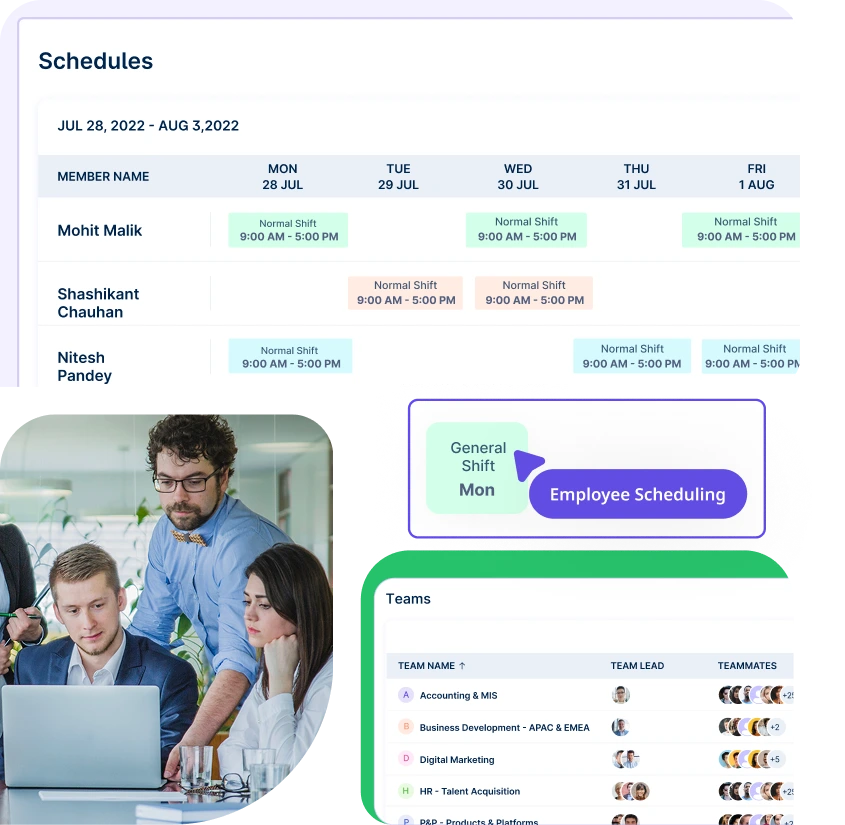

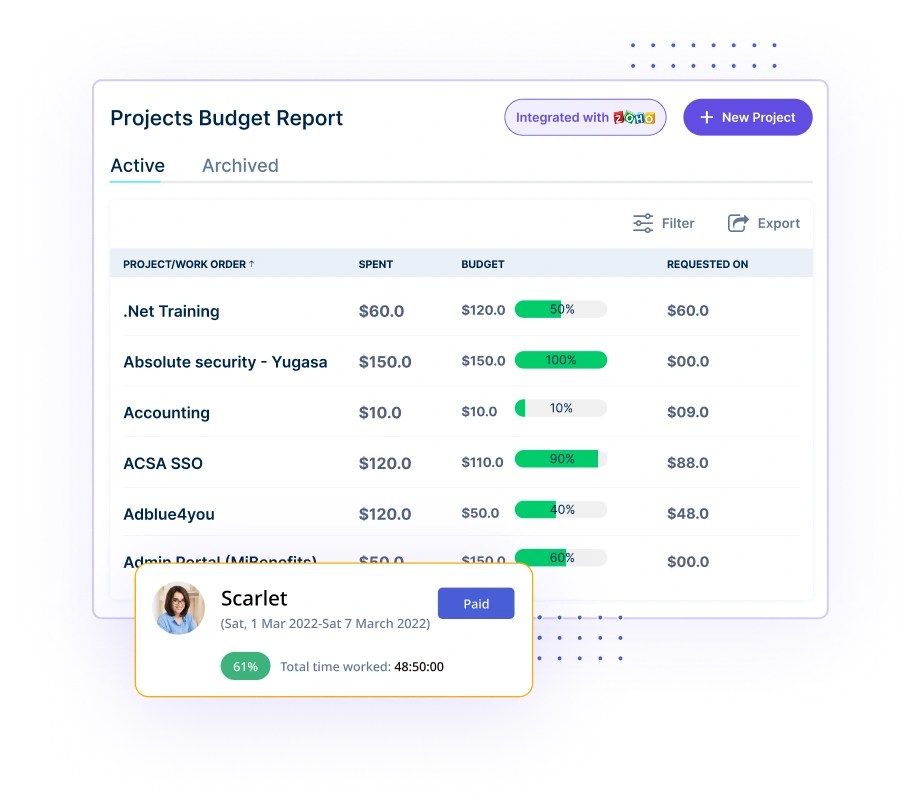

Workstatus is a cloud-based productivity management software that enables an organization to keep a check on its employees’ activity. Its following features enable HRs to calculate payroll hours accurately:-

- Automated Time Tracking: It allows HRs to track accurate billable hours using time tracking software. With the same, they receive the data to implement the payroll calculation formula accurately.

![]()

- Overtime Calculations: Workstatus allows you to evaluate overtime hours as per the company policy using the overtime calculator software. This accurate evaluation allows you to maintain fair practices that help you meet labor law requirements.

- Payroll Reports: You can generate real-time exportable reports for payroll processing. It makes the salary calculation process flawless.

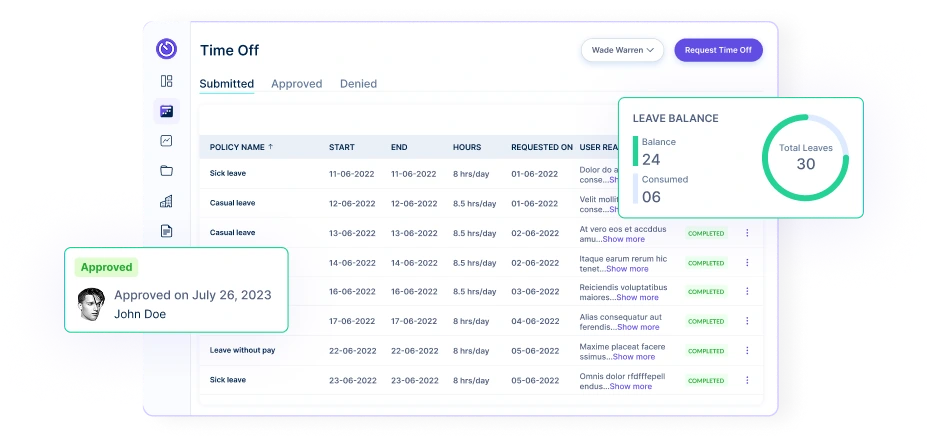

- Leave Management: Using Workstatus, you can track and manage all types of leaves and their records through time off management software. It allows you to make accurate deductions.

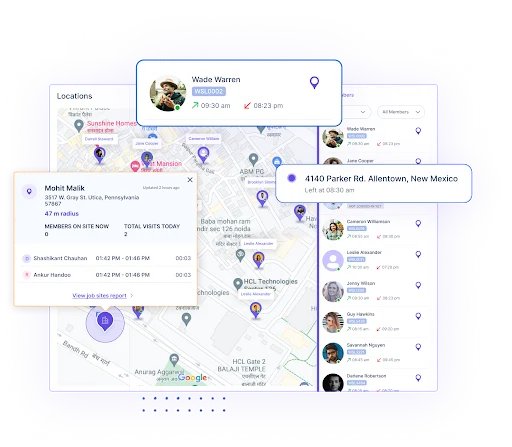

- GPS-Based Attendance: This feature logs employee attendance based on the specified location using GPS-based workforce management software. It keeps you safe from time fraud and allows you to make an audit-definable system.

With these features, Worksatus can be a complementary element for your payroll software. Moreover, it offers free templates, enabling you to manage the payroll of your employees flawlessly.

Free Payroll Calculation Templates

These free payroll calculation templates enable you to evaluate the payroll based on pre-standardized wage hours and payment cycles:-

- Hourly Employee Payroll Template: Businesses paying employees on an hourly basis can use the same template to track billable hours.

- Daily Payroll Template: It is suitable for businesses evaluating employees’ wages daily.

- Weekly Payroll Template: The weekly payroll template is best for organizations with a weekly pay cycle. It lets you consolidate daily inputs and monitor weekly work hours efficiently.

- Bi-Weekly Payroll Template: Perfect for companies that pay every two weeks. It helps HR teams track 14-day periods without missing overtime or underreporting.

- Monthly Payroll Template: This monthly payroll template allows seamless tracking of total hours worked across an entire month, simplifying end-of-month processing for salaried or hourly workers.

- Project-Based Payroll Template: Designed for freelancers or contract workers, this template links work hours directly to specific projects for transparent and accurate pay allocation.

These templates make the payroll bookkeeping and processing more organized. However, it is undeniably necessary to remain safe from any legal peril.

Legal Considerations for Payroll Calculations

The following are some of the legal considerations you need to consider when calculating payroll for employees:

- Fair Labor Standards Act Requirements: Employers must set their payroll practices so that they align with federal standards set by FLSA regarding minimum wage and overtime pay.

- Record-keeping Compliance: It is necessary to maintain detailed payroll records, including different metrics, like time worked, wages paid, and taxable deductions.

- Payroll Tax Filing Deadlines: Employers need to comply with the IRS payroll tax deadlines to avoid penalties and interest.

- Common Compliance Pitfalls to Avoid: Employers should refrain from common payroll mistakes, like overtime miscalculation, neglecting breaks, and employee classification.

Cost-Benefit Analysis: Manual vs. Automated Payroll

When it comes to benefits, cost benefits are the most tangible ones. The following are some cost benefits of automated payroll, including but not limited to:

- Time Efficiency: Timesheet software allows you to reduce the additional time involved in manual payroll processing. It reduces the administrative burden.

- Reduced Error Rates: The time tracking software offers a transparent and fully auditable framework with negligible errors due to minimal human intervention.

- Cost Comparison: When compared on the cost parameter, automated payroll may seem cost-intensive in the beginning. However, it offers a significant cost leap in the long run by reducing operational costs.

- Return on Investment: It helps you reduce payroll disputes by offering a base for accurate payroll calculations. With the same, it offers a higher ROI.

- Scalability: The time tracking software can easily scale with your expanding business.

Final Thoughts

Manual payroll processing makes you susceptible to blunders that have financial and legal repercussions.

Hence, you need to follow the chronology of the payroll formula implementation accurately. It may seem simple, but it is time and resource-intensive when done at a scale.

Workstatus is a time and attendance management software that allows you to have an efficient time and attendance management system.

With the same, you can automate the payroll evaluation framework and remain safe from the errors and their aftereffects.

Frequently Asked Questions

Ques. How Do I Calculate Payroll?

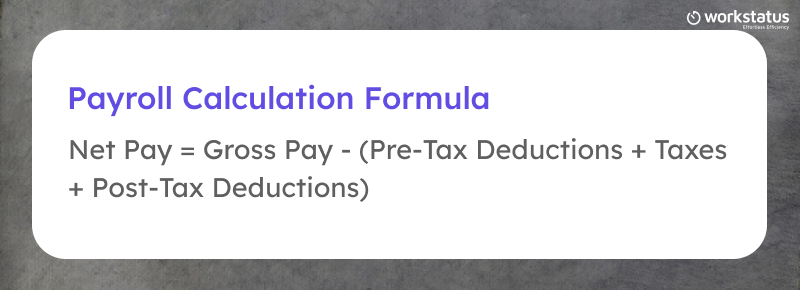

Ans. To calculate payroll manually, you need to gather time data, calculate gross pay, apply pre-tax and post-tax deductions, and determine net pay. The formula is: Gross Pay – (Pre-tax Deductions + Taxes + Post-tax Deductions) = Net Pay.

Ques. What Is A Payroll Calculation Formula?

Ans. The payroll formula is a structured way to determine net pay. It typically includes: Gross Pay = Hours Worked × Hourly Rate Then subtract applicable deductions and taxes to find the final net payout.

Ques. How Can Payroll Templates Help In Weekly Payroll Processing?

Ans. Weekly payroll templates standardize the recording of work hours, overtime, and applicable deductions for a 7-day period. They help HRs and accountants streamline weekly payouts and reduce errors.

Ques. Can I Automate Payroll Calculation Using Software?

Ans. Yes. Time tracking and payroll software like Workstatus can automate billable hours, overtime, leave, and payroll reporting. This ensures greater accuracy and compliance with tax laws.

Ques. How Do I Calculate Payroll Hours For Remote Or Field Workers?

Ans. Use GPS-enabled time tracking or timesheet software to record accurate work hours for remote staff. This prevents time fraud and supports transparent payroll processing.